Property Market Report - November

We have a four insightful views of the Australian Property Market for November. Three opinions from buyers agents Chris Gray Your Empire Sydney, Lauren Staley infolio Melbourne and Zoran Solano Hot Property Buyers Agents Brisbane. Plus, we have the link to the YouTube CoreLogic Property Market Update from the Stat-man himself, Tim Lawless CoreLogic Research Director Asia Pacific.

Key Points from the Your Empire November Update;

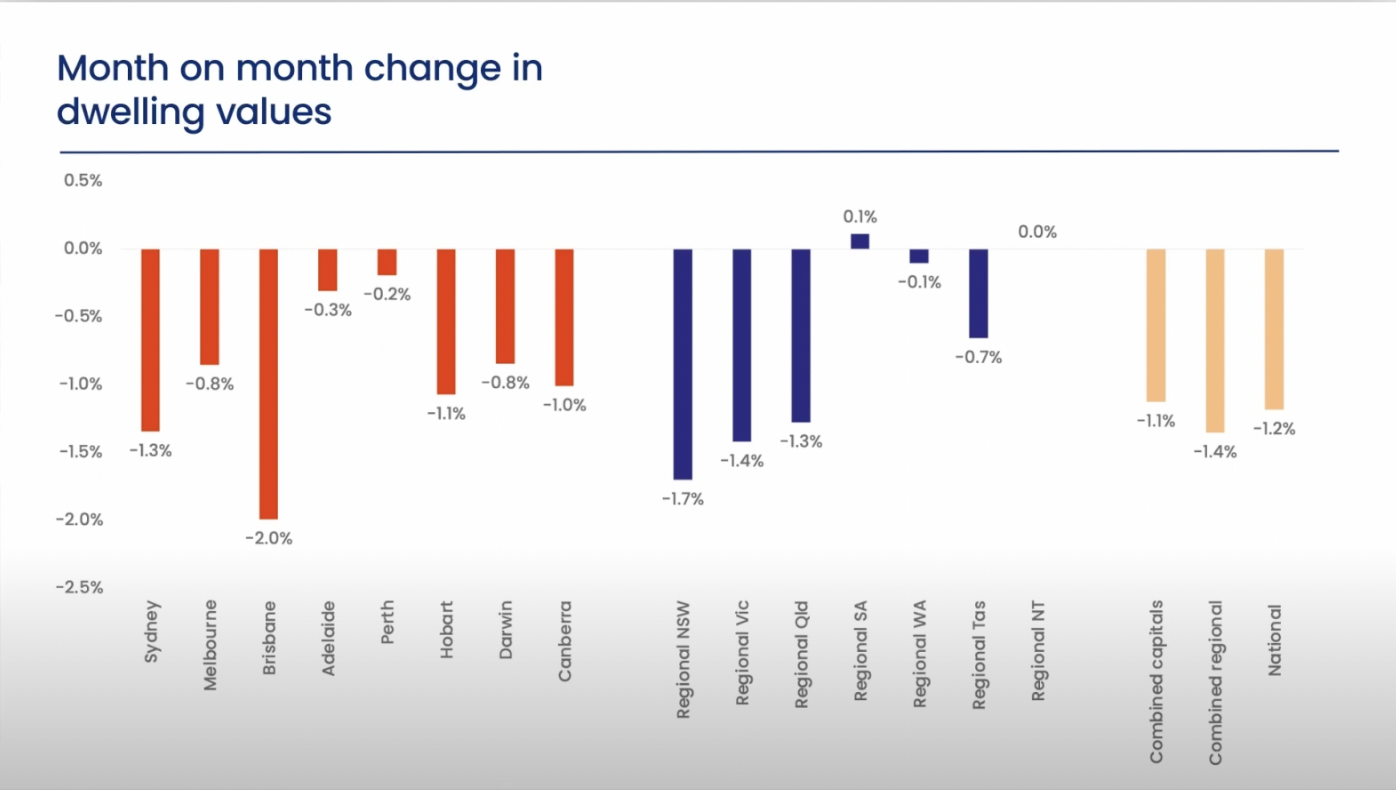

Ignore the Media - Nationally only down HVI 6% from the market peak, Value of sales is 4% higher than 5-year average.

Buyers are now in control, Vendors are discounting

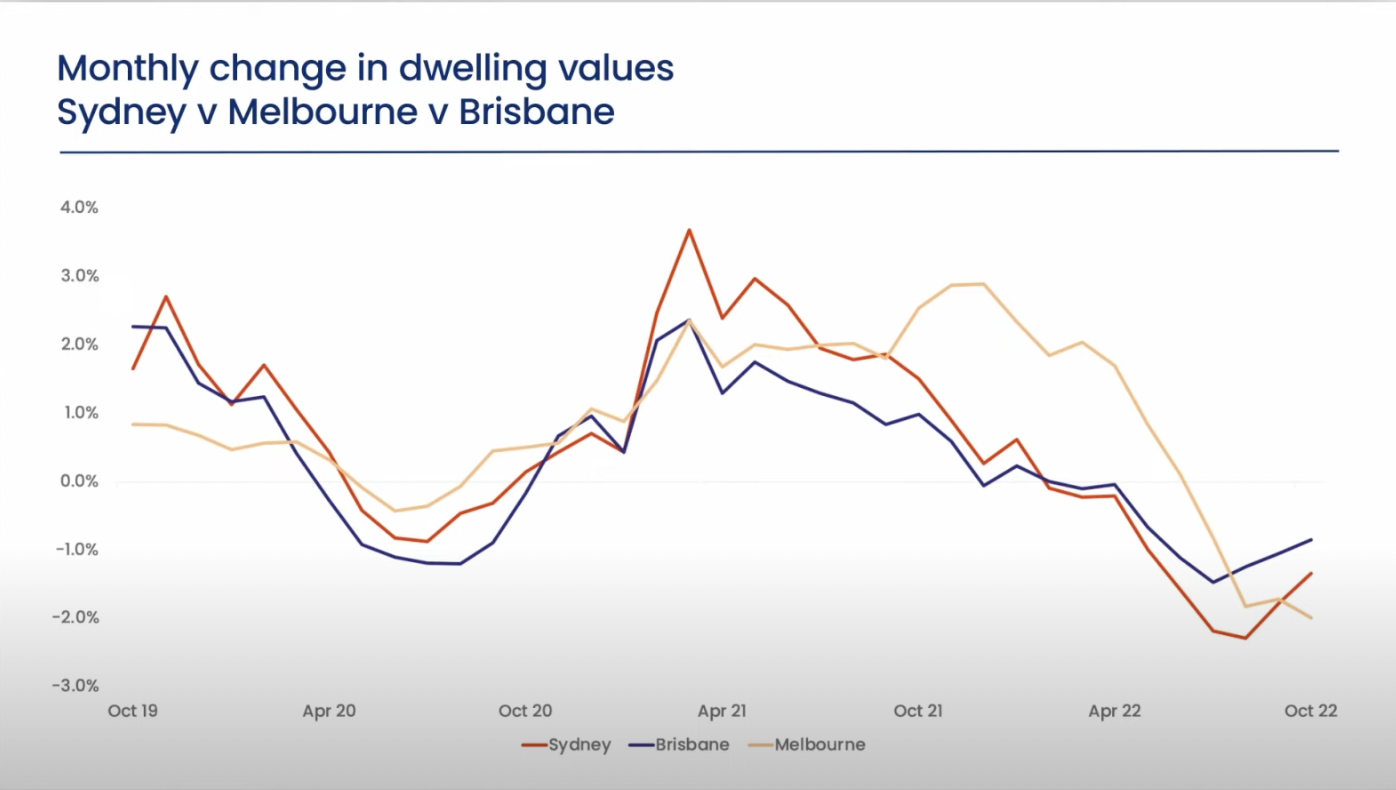

Brisbane has become a buyer’s Market

More of a drop in Renovators Delight Property as Buyers are concerned about the building costs and arranging the work to be done to their property.

Renovating properties are holding their value.

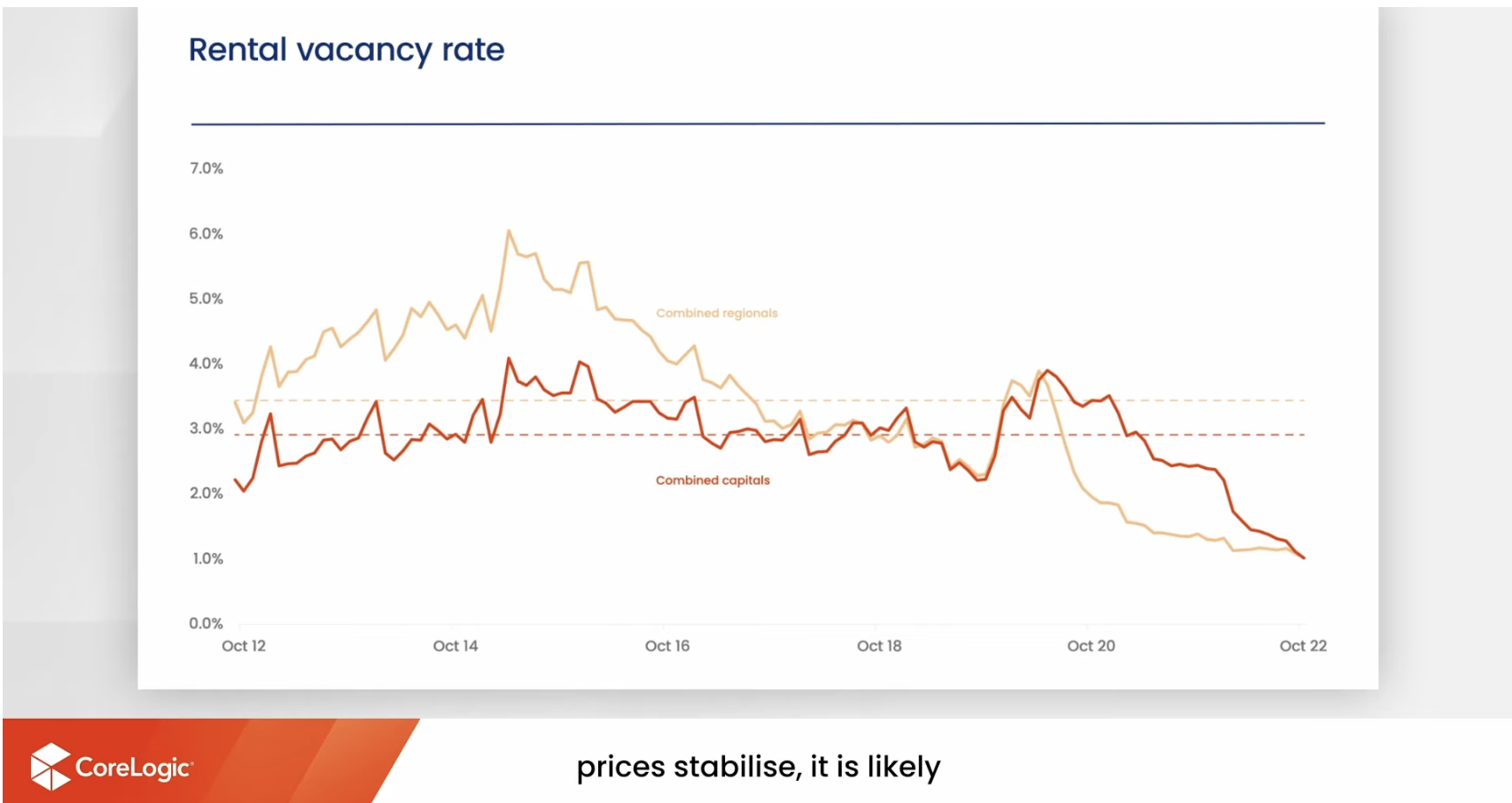

Interest in Units due to the increase in rental yields. More investment buyers on the market in Brisbane Units.

Take advantage of the market. Have the confidence to be a leader.

Many Vendors are holding off putting their property on the market until 2023. Contributing to low stock.

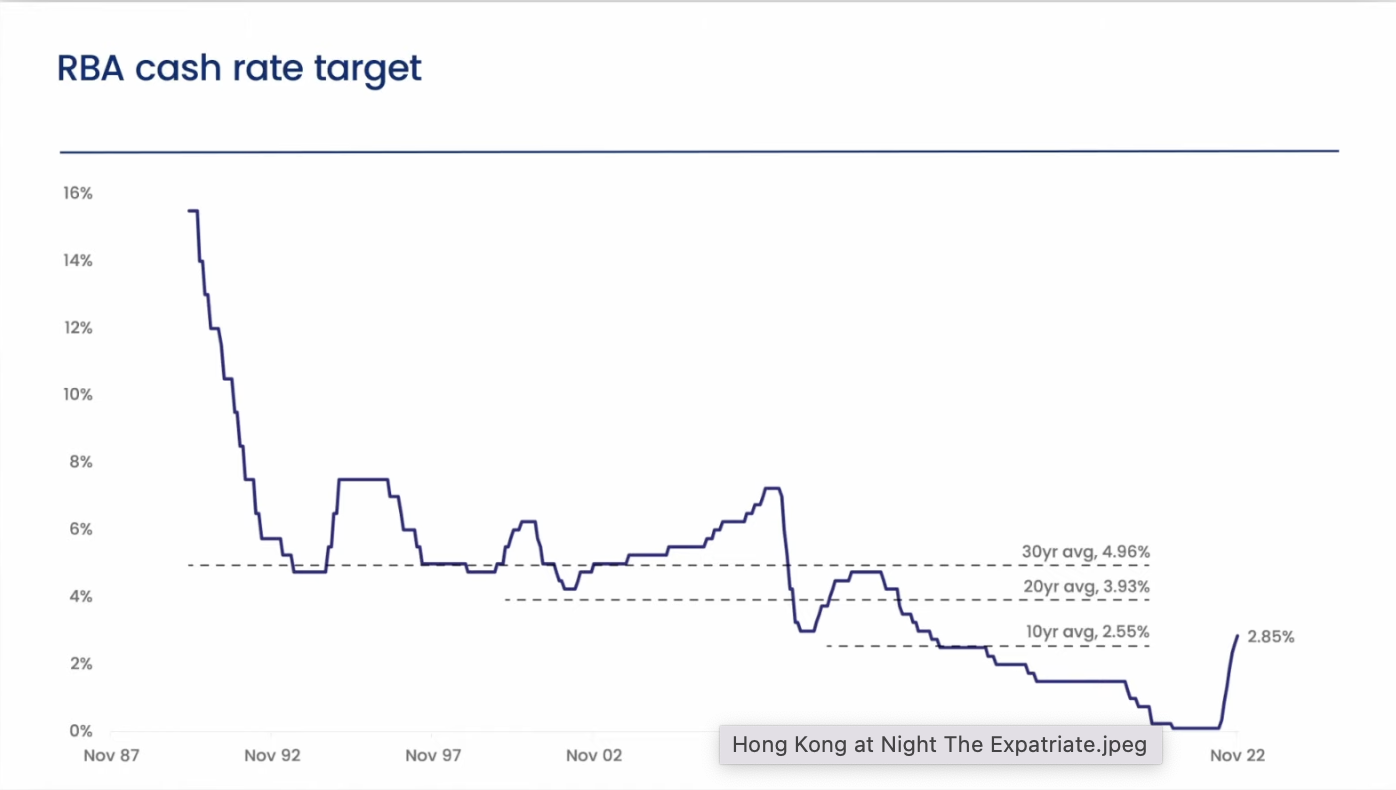

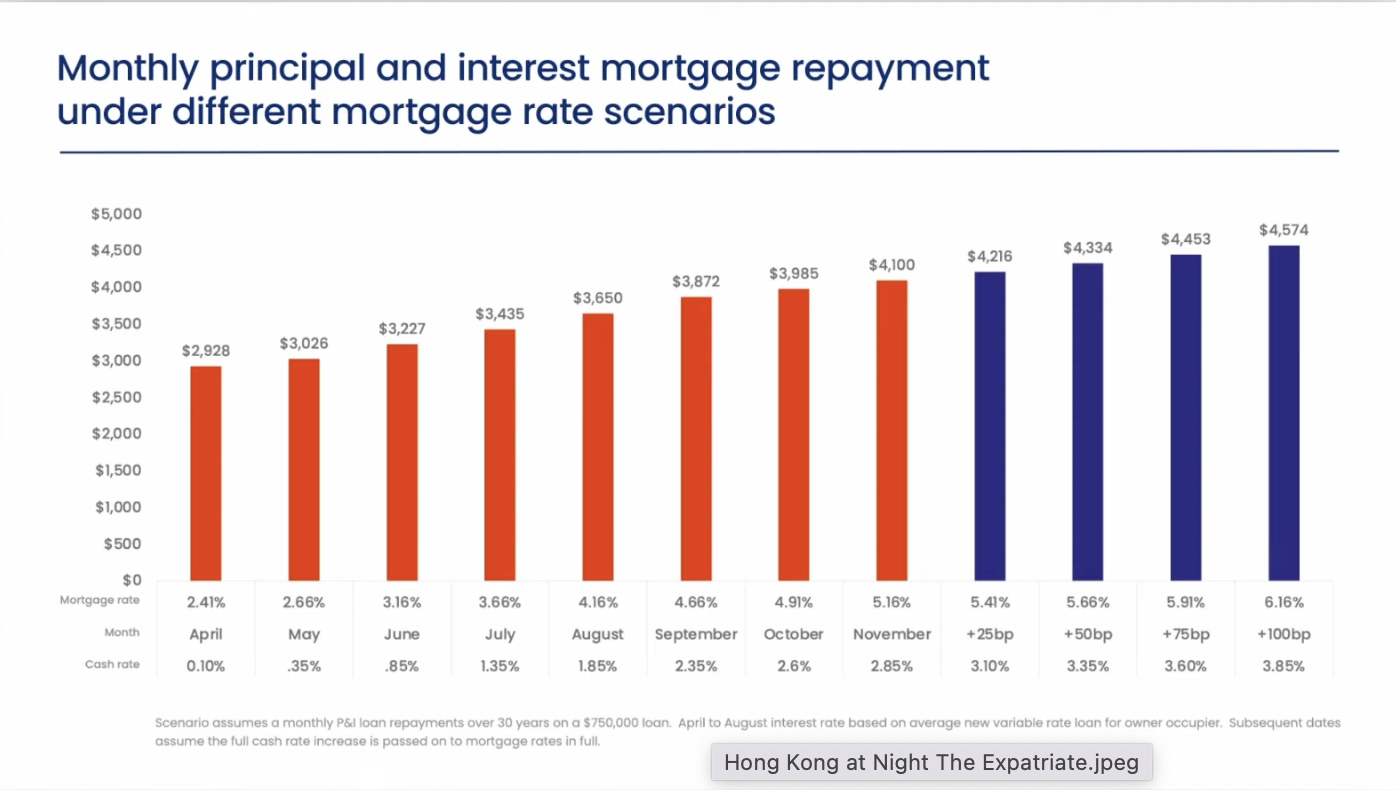

As interest rates rise, preapproved finance is harder to obtain.

We are not seeing buyer distress

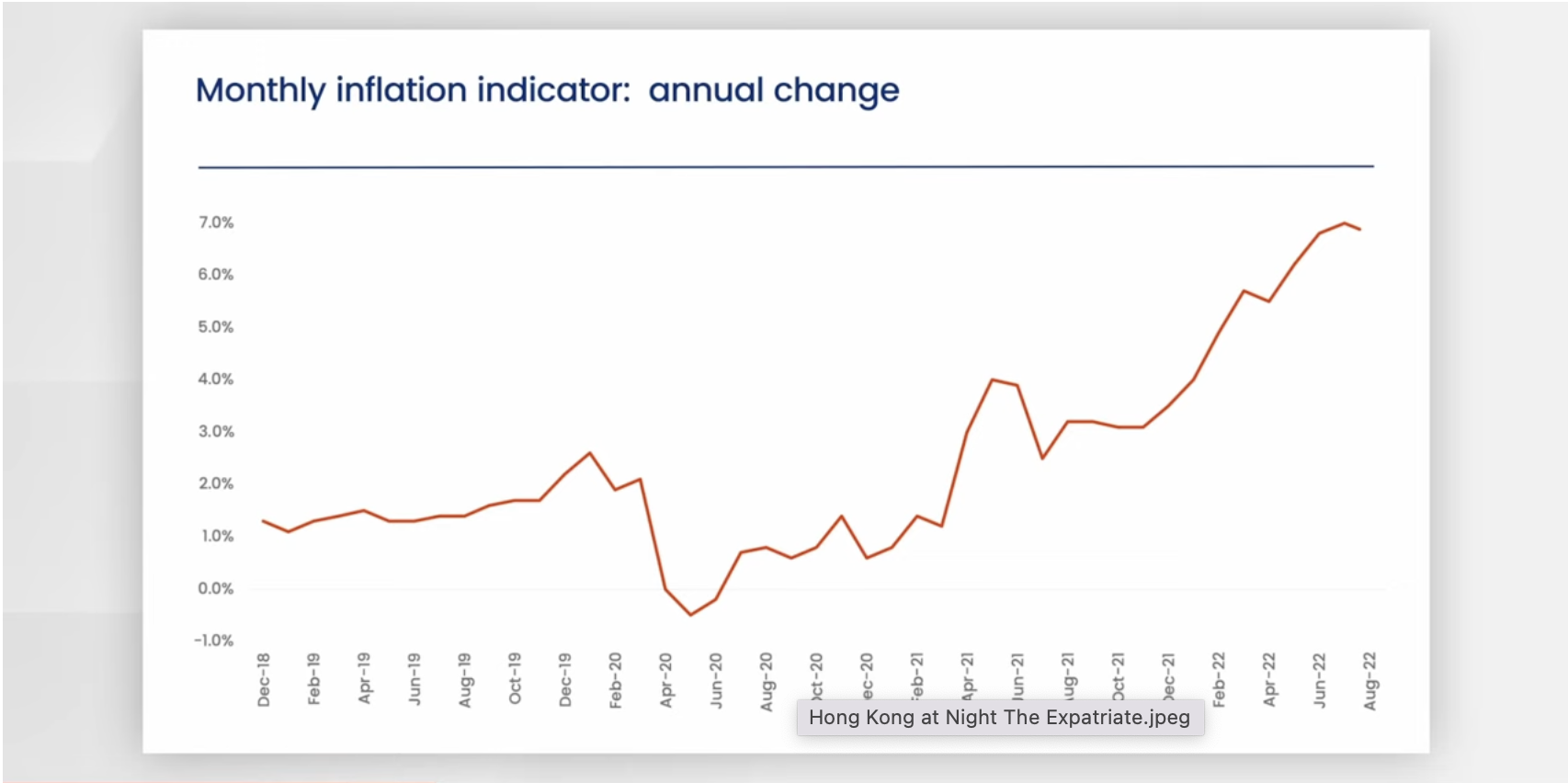

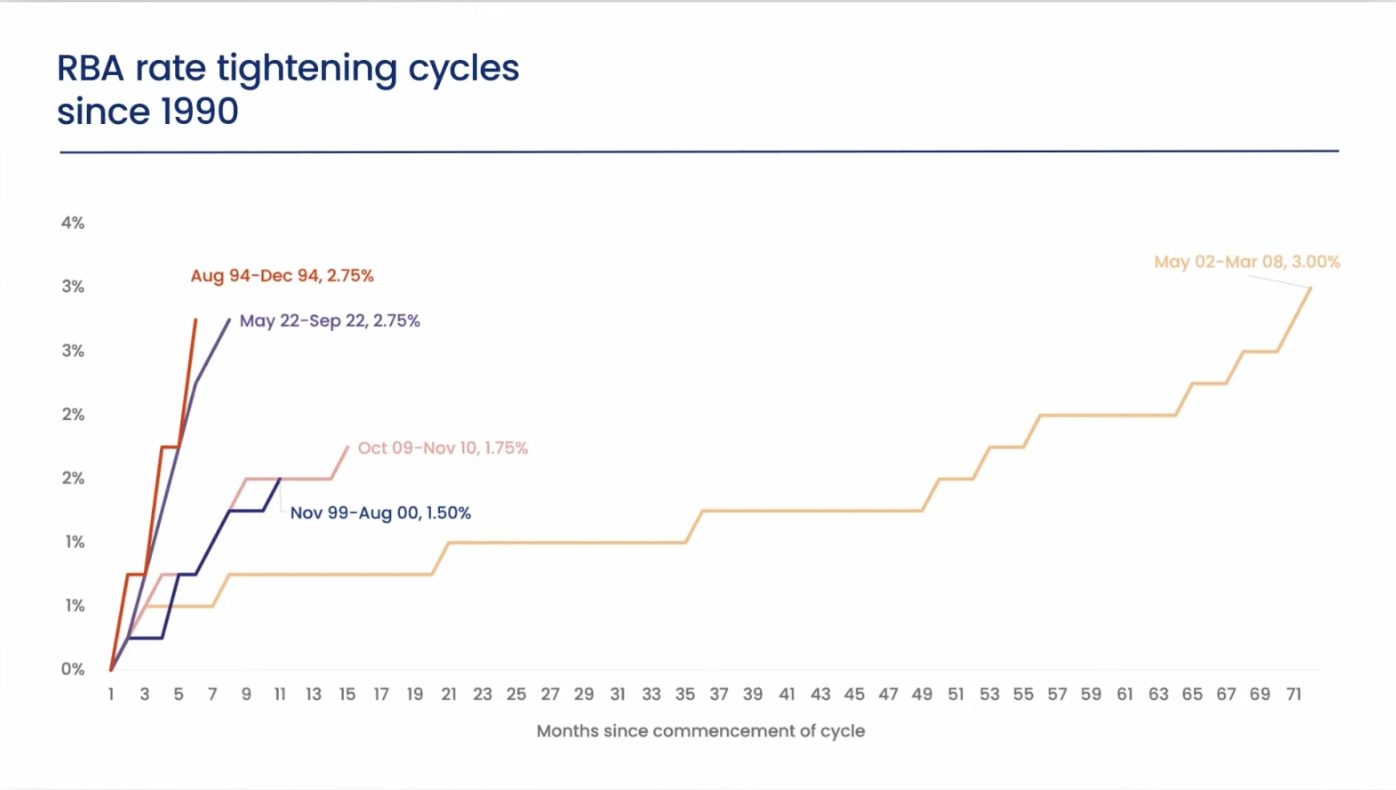

Lauren Predicts another interest rate rise in March. Then Stabilisation.

T/Cs around Christmas period, work of Business Working Days BWD, not days to allow for public holidays. 5BWD for Building and Pest and 10 BWD for Finance.

CoreLogic November Property Market Report - Tim Lawless Research Director Asia Pacific.

Key Points;

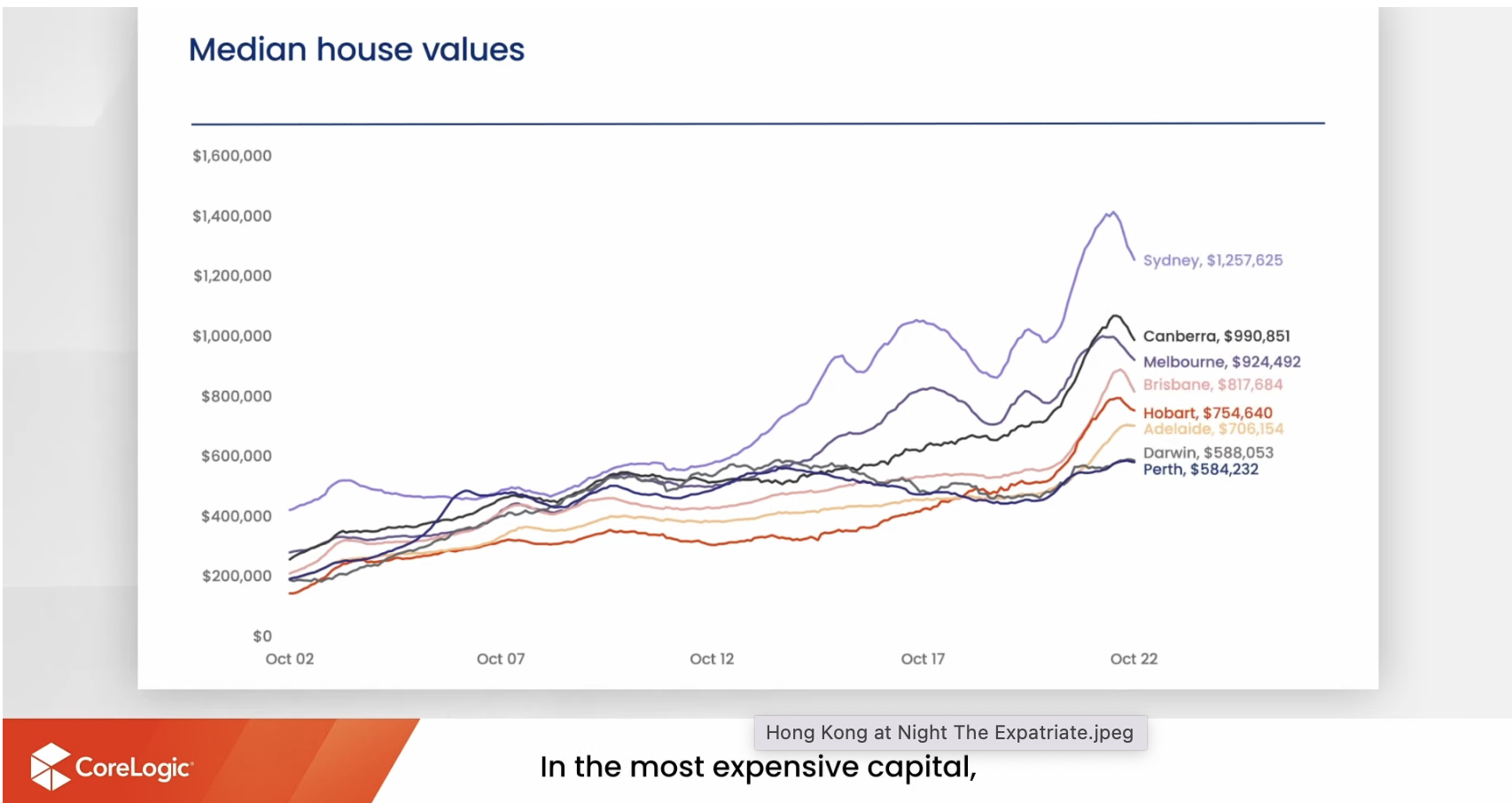

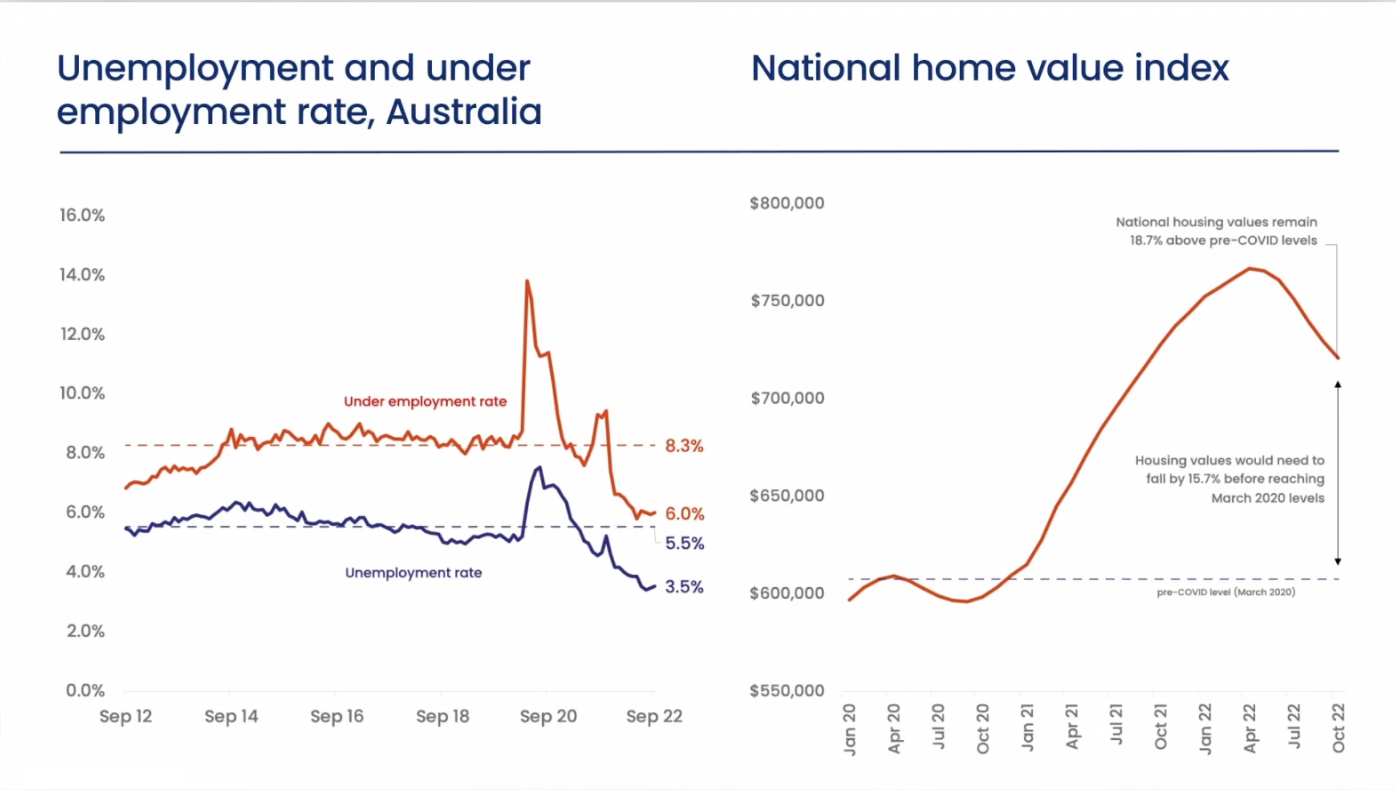

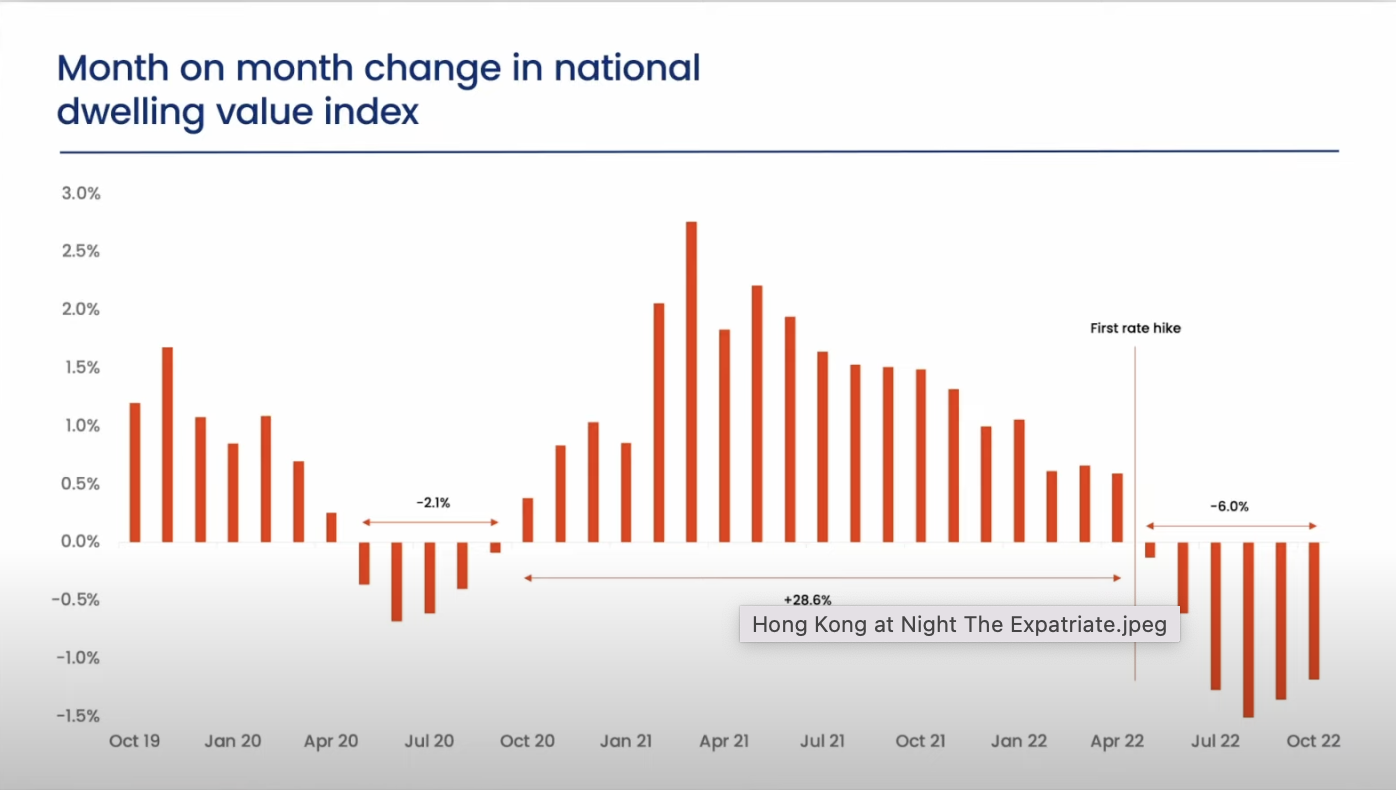

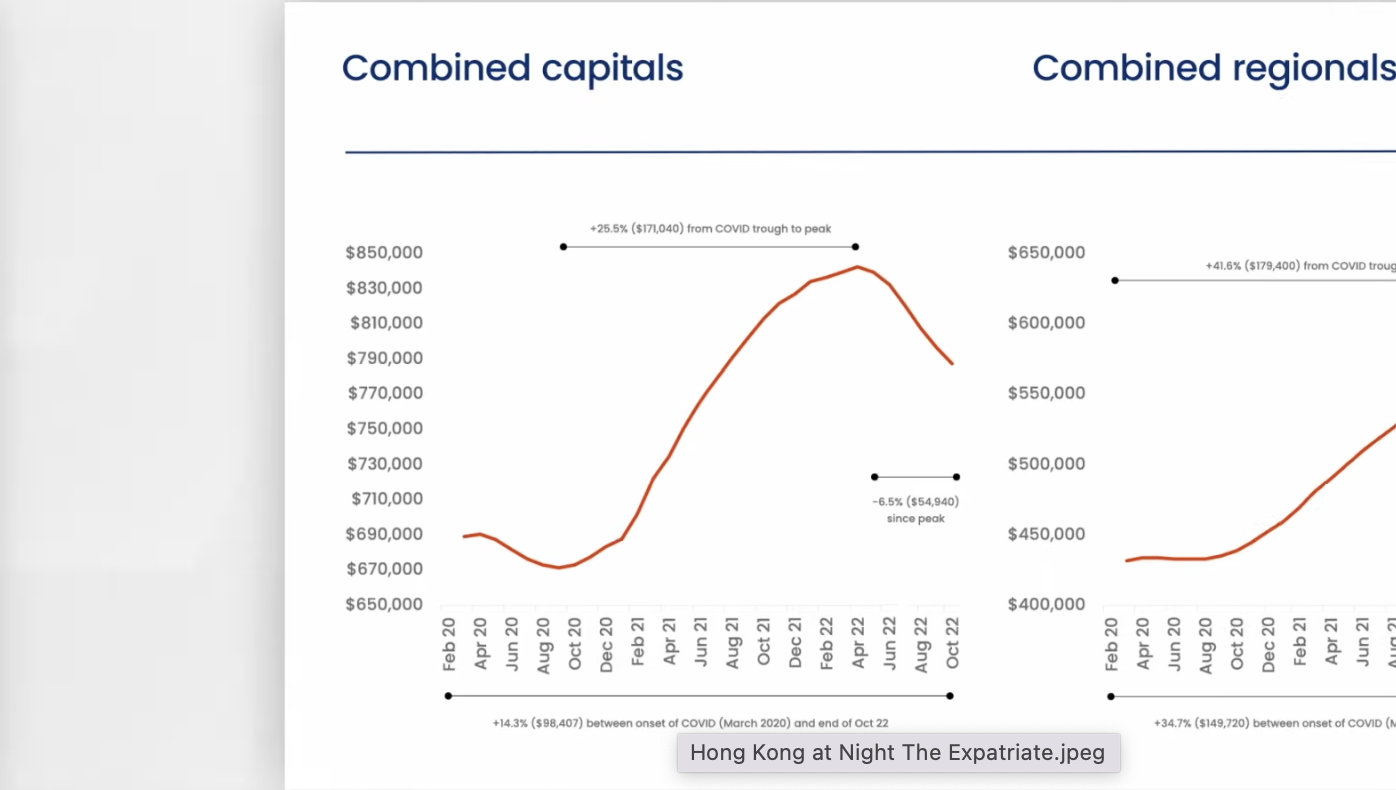

The Australian property market is Down a further 1.2%, 6% down from the market peak, rate of decline has slowed.

We are seeing an orderly downturn - not a crash.

4% More Sales than the 5-year average

Higher than average homeowners on Fixed Mortage Interest rates since 2020 at the start of the pandemic; therefore, they will be buffered until June 2023.

Homeowners with mortgages have an average of twenty months of mortgage repayments either in their offset accounts or in their savings.

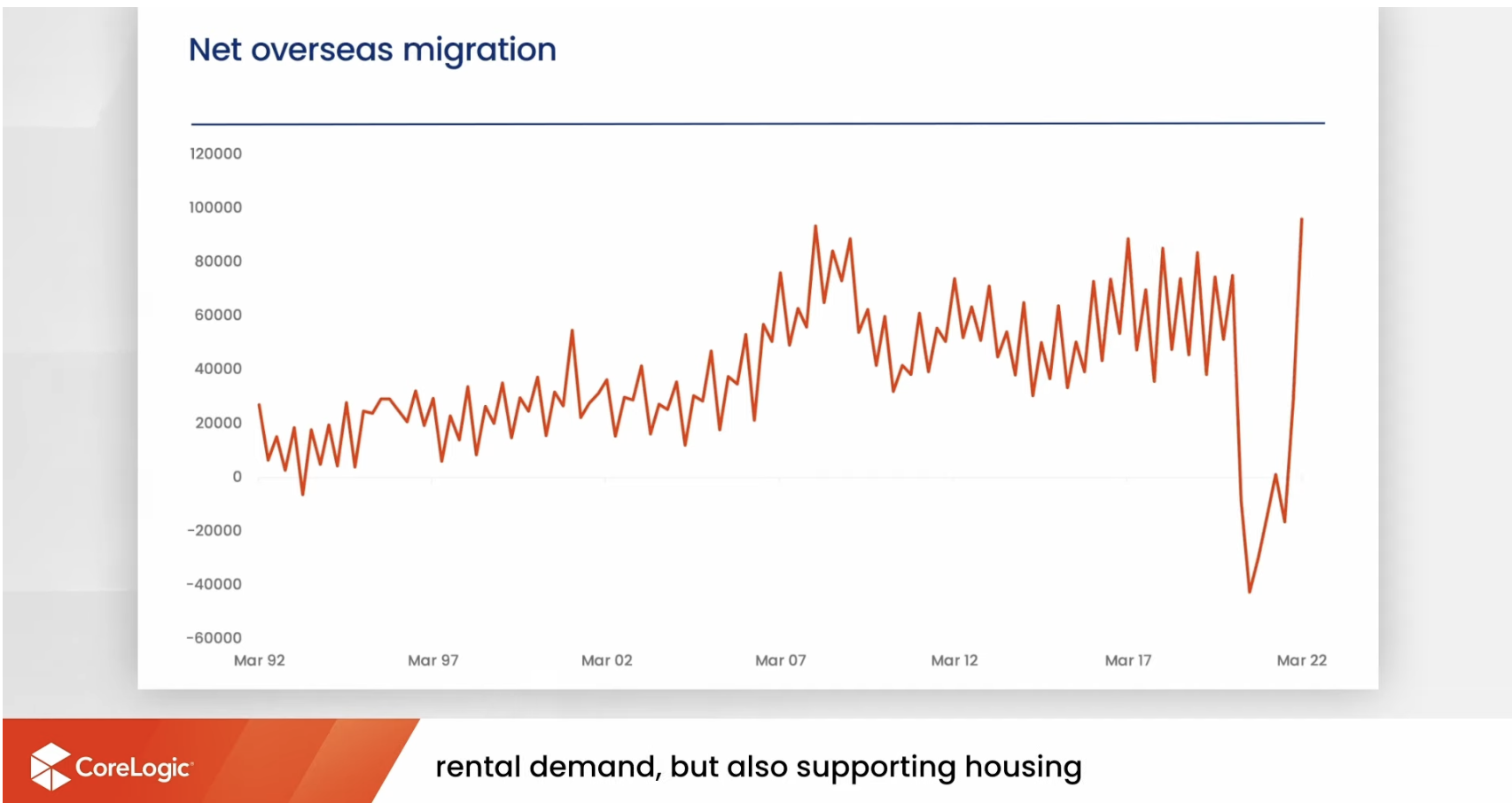

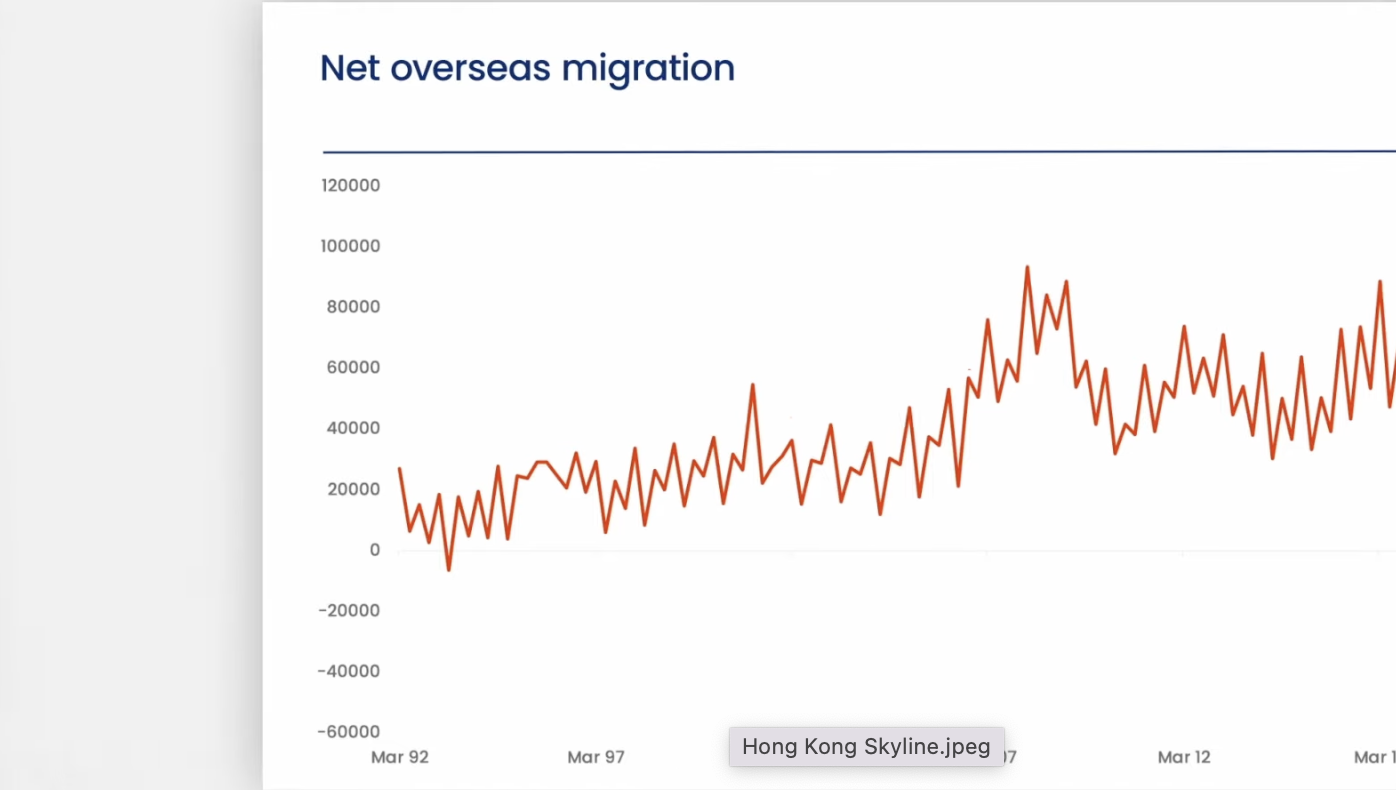

International Immigration has bounced back fast since the borders opened post-Covid Border Clousers.

Low unemployment - Buyers are not distressed.

If you sell, stand out or invest in a high-quality advertising campaign.

Buyers Market - Vendors are discounting.

Homes are taking longer to sell. You have more time to make the transaction; take your time and make the right decision.

Scourse - CoreLogic Australia