Send Payments Weekly Trading Update 6th January 2025

Send Payments Weekly Trading Update 6th January 2025

In The News🌏 – Market Conditions and what to look out for this week 🗓️

AUD/GBP Exchange Rate

AUD/GBP dropped to multi-year lows over the Christmas period, dropping into the low 0.49's before regaining the 0.5000 level on Thursday.

Throughout December, the rate dropped to 5.1%, starting at 0.5200 and ending the month at 0.4930.

The AUD has dropped rapidly against various currencies due to potential rate cuts in Australia and a broad risk-based sell-off in the currency.

Send Payments Market Update 28th October 2024.

Send Payments Market Update 28th October 2024 PLUS Competition.

Send Payments Competition

When you make an international transfer with Send from 13th October 2024 to 31st December 2024, you'll go into the draw for the chance to win 1 of 5 $500 Luxury Escapes vouchers when you transfer $AUD 10,000 or more. T&C’s apply*

Send weekly trading update—21st October 2024

Send weekly trading update—21st October 2024

In The News Today! 🌏 – Market Conditions and What to Look out for this Week 🗓️

RBA and Global Rate Cuts:

The RBA is expected to hold rates until May next year after strong domestic employment data slashed the chances of a rate cut this year.

Rate cuts from other central banks, such as the Fed in America and the RBNZ, are pressuring discussions on potential easing elsewhere.

CoreLogic - Australian Million Dollar Markets. Is your suburb there?

CoreLogic - Australian Million Dollar Markets. Is your suburb there?

Thank you, CoreLogic Australia Economist Kaytlin Ezzy and CoreLogic Australia Team, for sharing the comprehensive data and insights from the CoreLogic Million-Dollar Markets report as of June 2024 with the entire THE EXPATRIATE Community. We’ve put together some key points from the report. We hope you like them.

In August, 29.3% of Australian suburbs had a median house or unit value of $1 million, including 3,426 homes and 1,346 units from 4,772 suburbs. This is an increase from 21.7% in January 2023. The current percentage exceeds the 26.9% recorded in April 2022 at the last market peak. Despite high interest rates, low consumer confidence, and declining affordability, Australia's housing market has remained resilient over the past 18 months, with home values steadily rising since November 2023.

Send Payments Weekly trading update.

Send Payments weekly trading update.

In The News 🌏 Market Conditions and what to look out for this week 🗓️

AUD

The Australian Dollar (AUD) is expected to strengthen against the Euro, Pound, and U.S. Dollar through 2025, according to Westpac, a major Australian lender.

Westpac predicts the AUD will rise due to improving global sentiment and the Reserve Bank of Australia (RBA) maintaining a firm stance on inflation.

Luci Ellis, Chief Economist at Westpac Group, believes that the RBA will not cut the cash rate until inflation is sustainably within the 2–3% target range.

Australia's Consumer Inflation Expectations eased to 4.4% in September, slightly down from the four-month high of 4.5% in August.

Send Payments Weekly trading update, 2nd September 2024.

Send Payments Weekly trading update, 2nd September 2024.

Australian Dollar Outlook

The Australian dollar is expected to advance further with support from the RBA, but the process remains slow due to constraints from China.

Sydney-based analyst Oliver Levingston notes that interest rate differentials between Australia and other regions are set to remain "an especially important tailwind for the AUD and the main reason AUD is likely to move higher against G10 FX crosses by year-end."

"G10 crosses" refers to non-USD Australian Dollar exchange rates, such as the Pound to Australian Dollar and Euro to Australian Dollar pairs.

Send Payments International Currency Update 26th August 2024

Send Payments International Currency Update 26th August 2024

In the news! 🌏 – Market conditions and what to look out for this week 🗓️

AUD/USD

Fed Chair Jerome Powell said the "time has come" for interest rate cuts.

The US Dollar (USD) will likely remain under pressure after US Federal Reserve Chairman Jerome Powell’s dovish Jackson Hole speech.

The US Durable Goods Orders for July are due later on Monday.

Send Payments Weekly International Currency trading update

The latest Send Payments International Currency Market Update provides an in-depth exploration of the movements seen in major currencies, including the USD, GBP, CNY, NZD, and JPY.

In the news this week.

Jackson Hole and the Fed

Central bankers, academics, and journalists are gathering at the mountainside resort of Jackson Hole on Friday, where Federal Reserve Chair Jerome Powell is set to deliver a much-anticipated speech. This event has become known as the "Davos for central bankers" over the past four decades.

Powell is expected to outline a road map for US interest rates in an address that will be highly significant economically and politically.

While his immediate audience includes central bankers and experts at the Jackson Lake Lodge, Wall Street will analyse the speech closely for clues on the Fed's future policy moves. Rivals in the US presidential race, Kamala Harris and Donald Trump will also be watching, with the November election looming.

Send Payments Weekly Currency Update.

The latest Send Payments International Currency Market Update provides an in-depth exploration of the movements seen in major currencies, including the USD, GBP, CNY, NZD, and JPY. It examines the key events that have significantly impacted the values of each of these currencies. Additionally, the report highlights what to watch in the media and financial sectors throughout this week, ensuring that readers stay informed about potential market shifts and developments.

Send Payments Weekly trading update.

Send Payments Weekly Trading Update. In The News 🌏 Market Conditions and What to look out for this Week 🗓️

AUD: Under Pressure – Commerzbank

The Australian Dollar (AUD) is under significant pressure, losing about 0.7% against the US Dollar (USD), according to Commerzbank’s FX analyst Volkmar Baur.

The AUD was affected by lower-than-expected inflation, which has reduced expectations for further rate hikes by the Reserve Bank of Australia (RBA). The RBA are due to announce Australia’s interest rate on Tuesday at 2:30pm, there is no expected change.

The AUD's strong reaction also seems tied to ongoing economic weakness in China, Australia’s largest trading partner. Weakness in China, especially in the housing market, could impact Australian exports and thus the currency.

Send Weekly AUD trading update

Send Payments Currency Market Update - International Currency Market Conditions and What to look out for this Week 🗓️

AUD Performance

- The Australian Dollar (AUD) became the worst-performing G10 currency on a 1-day view in broad risk-off market sentiment, according to Rabobank’s FX analyst Jane Foley.

- Despite the risk that the RBA could hike interest rates at its August 6 policy meeting, the AUD’s poor performance reflected potential headwinds from continued weakness in the Chinese economy.

Send Weekly Currency Update 22nd July 2024

In The News 🌏 – Market Conditions and what to look out for this week 🗓️.

AUD/USD

US President Joe Biden's exit from the presidential race increased the odds for former President Donald Trump and boosted investors' appetite for riskier assets.

Experts argued that Biden’s decision would increase market volatility, though the market reaction has been limited so far.

Peter Earle, senior economist at the American Institute for Economic Research, stated that investors may seek a safe haven until they can assess Biden’s replacement policies.

Dovish Fed expectations prompted fresh US Dollar selling.

Pairs where AUD is the weaker currency, such as EURAUD and GBPAUD, are now in focus.

Send Currency Update 15th July 2024

Send Currency Update 15th July 2024

In The News! 🌏

Market Conditions and What to look out for this week 🗓️

AUD Outlook and Market Performance

Rabobank is predicting continued outperformance for the Australian Dollar (AUD).

Rabobank anticipates the RBA raising interest rates twice in 2024, in August and November, to combat persistent domestic inflation.

Jane Foley, Senior FX Strategist at Rabobank, stated, "Most recent Australian economic data have cemented our expectations for further rate hikes this cycle."

Send Payments Weekly trading update! 27th May 2024

In The News Today! 🌏

– Market Conditions and what to look out for this week 🗓️

Australian Dollar Performance:

The Australian Dollar (AUD) gained ground due to risk-on sentiment following softer UoM 5-year Inflation Expectations reported on Friday.

Australian equities rose above 7,770, buoyed by gains on Wall Street.

The AUD extends its gains against the US Dollar (USD) for the second consecutive session on Monday, driven by improved market risk appetite despite diminishing expectations for Federal Reserve interest rate cuts.

Off-market buying is on the rise.

Off-market buying is on the rise.

Off-market buying has become a significant focus for Infolio, with our number of off-market transactions surpassing any other buyer’s advocate in Melbourne. Over 53% of the properties we secure for our clients are sourced through off-market channels. This trend is particularly evident in the acquisition of family homes, especially those with four or more bedrooms in sought-after areas like Bayside and Stonnington. We recently acquired three off-market family homes in Brighton East on the same street all priced between $3.8 and $4.5 million.

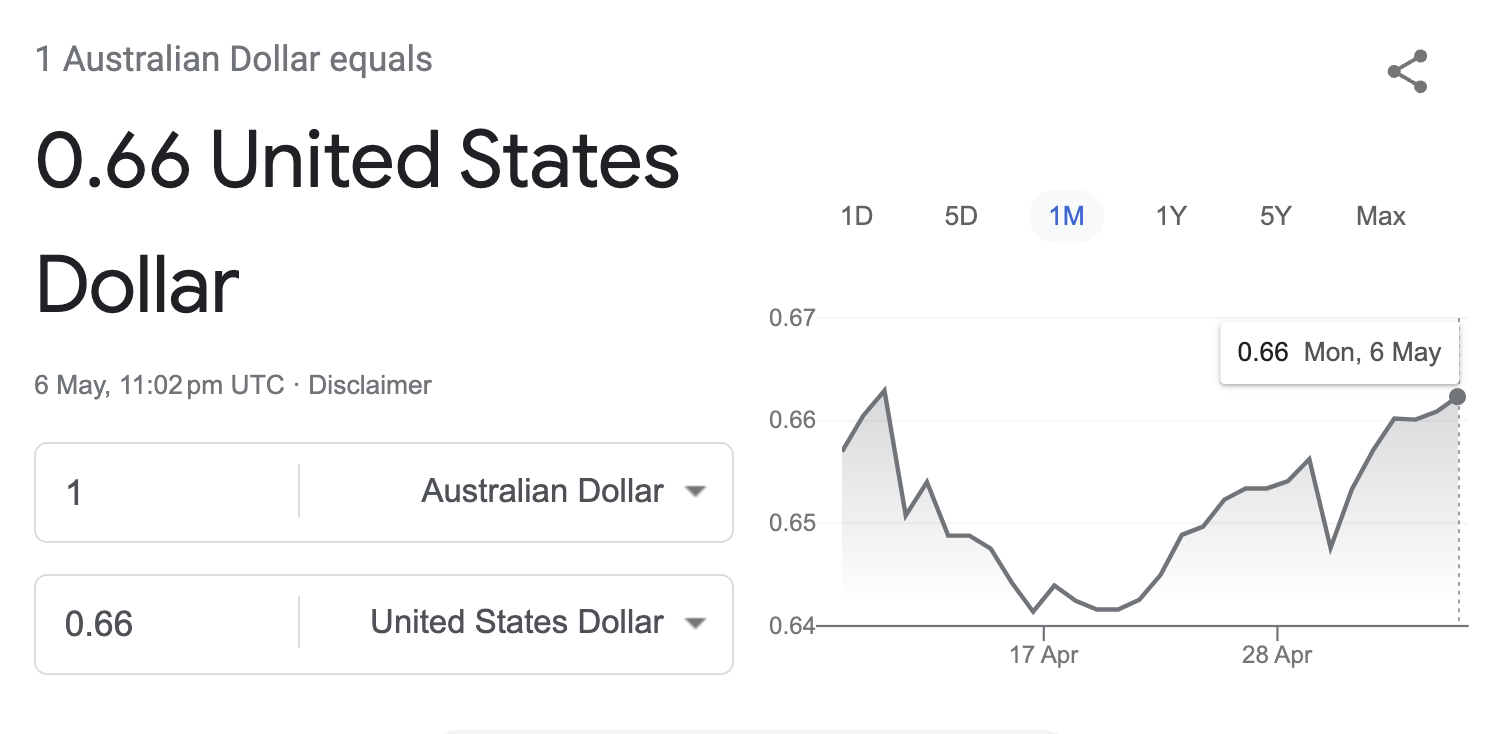

Send Currency Update Published on May 6th 2024

Send Currency Update Published on May 6th 2024

In The News 🌏 Market Conditions and What to look out for this week 🗓️

Speculation on RBA Rate Hike:

Capital Economics is forecasting a 25 basis points rate hike, citing stickier and stronger inflation than expected by the Reserve Bank of Australia (RBA).

The RBA has historically increased interest rates when the trimmed mean quarterly inflation has been at least 1 percent, which was the case in the March quarter.

Send Payments Weekly trading update on 5th March 2024!

Send Payments Weekly trading update on 5th March 2024!

Thank you Ian Cragg and the Send Payments Team for sharing the “Send Payments Weekly trading update!” With THE EXPATRIATE Community.

In The News Yesterday! 🌏

– Market Conditions and what’s in the calendar 🗓️

Economic Data Snapshot:

January building approvals in Australia fell below expectations.

Q4 inventories slumped, raising concerns about the potential impact on Q4 economic growth.

Despite a surge in company profits, the inventory number poses a challenge for the upcoming GDP report.

Send 26/02/2024 Currency Trading update!

Send 26/02/2024 Currency Trading update! In The News Today! 🌏 Market Conditions and What’s on the Calendar 🗓️

Send Currency Update 29/01/2024

In The News Today! 🌏

– Market Conditions and what to look out for this week 🗓️

EUR/USD is trading below 1.0850 in Asian trading on Monday. The pair's downbeat tone is supported by further US Dollar demand amid rising geopolitical tension in the Middle East. Investors will be watching these developments closely prior to a busy end of the week.

Send Currency Update 11th December 2023

Send Payments AUD Currency Update 11th December 2023

Send Payments -In The News Today - Update on AUD/USD Pair – Market Analysis

AUD/USD rates hit 4-month highs last Monday prior to the RBA interest rate. The increase was mainly due to an increase in gold pricing and risk-on market sentiment, though this was short-lived after the RBA announced interest rates would hold at