TE in HK Event🏡 May 2025 Expat Property Update – Market Moves, Tax Wins & Fast Finance

Hello Global Aussies,

Whether in Hong Kong, London, Singapore, the UAE, or LA, this update is for you. As always, our focus at THE EXPATRIATE is helping you grow wealth from abroad through Australian property.

Here's what you need to know this month:

TE in HK

We are proud to host another Expat Information night with special guest speakers Adam Kingston, Australian Expat Mortgage Specialist and Michael Purvis, Financial Planner and unpack the current financial landscape in our latest TE in HK Event.

From exchange rates and interest rates to the Australian property market and lender rules, the night showcased the present as a unique opportunity to build and protect wealth.

If you missed the event and would like access to the slides, please reach out, we will happily share the slide deck with you.

🌏 CoreLogic Market Update – Why Expats Should Pay Attention

CoreLogic's May report shows the Australian market still has legs:

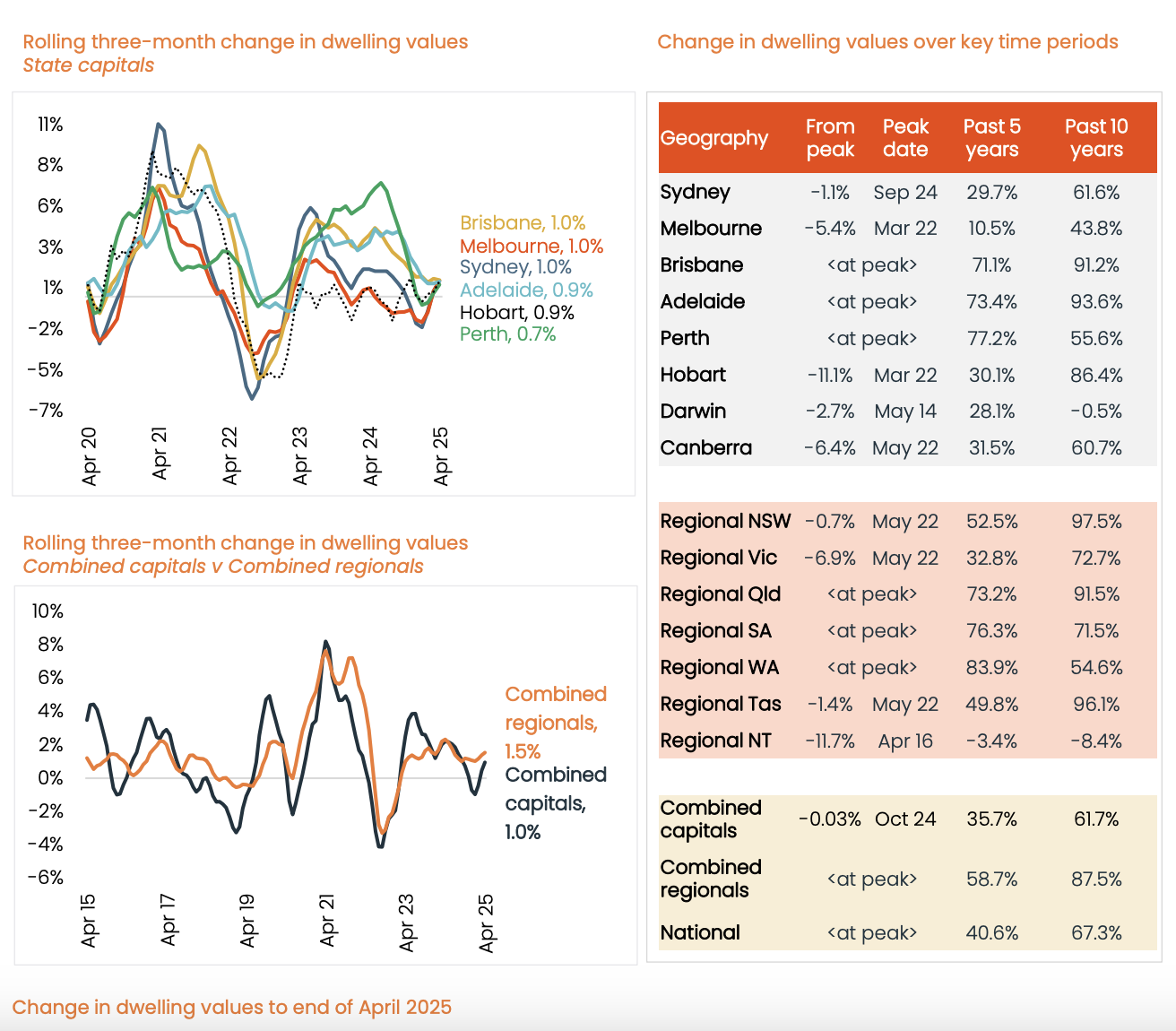

According to CoreLogic’s latest Housing Value Index:

National home values rose 0.3% in April, the 15th month of growth.

In just one month, Brisbane +0.4%, Perth +0.4%, and Adelaide +0.3% led the gains.

While Sydney and Melbourne are cooling slightly, this presents ideal opportunities for strategic buyers and refinancers.

For the Quarter: Brisbane, Sydney and Melbourne all increased 1% for the Quarter, with Perth +0.7% and Adelaide +0.9%

These shifts reinforce that property remains one of the most powerful tools for wealth creation, especially when used with insight and confidence.

👉 For expats, this is a unique window to buy or refinance while the market is strong, the AUD is favourable, and competition is moderate. To read the full CoreLogic Report, click on the button below.

🥂 Tax Strategy Spotlight – BMT Depreciation Insights

Adam and the Team were in HK. I was back in Brisbane for the BMT Tax Depreciation celebrations at Customs House this month. The insights are critical for expats, too.

Did you know you could claim thousands in deductions—even from overseas?

Key points for expat investors:

Depreciation is the second-largest deduction available to property investors

BMT finds an average of $11,000 in first-year claims

Their fee is 100% tax-deductible

You don’t need to be in Australia to benefit—own a property there

If you’re unsure whether your investment property qualifies, I can connect you with BMT so they can organise an estimate for you. If you’d like to learn more about Tax Depreciation, here is a Guide to Tax Depreciation for Investment Properties Below.

⚡ Fast Financing – 40-Minute Pre-Approval for a Client!

Yes, it’s possible.

One of our clients achieved pre-approval this month in just 40 minutes thanks to streamlined paperwork and strategic preparation.

Stay tuned for more expat updates.

The information contained is general information only and does not consider your personal objectives, financial situation and needs. We strongly recommend that you do not act on any information provided in this website without individual advice from your trusted advisor. You should also obtain a copy of and consider the Product Disclosure Statement for all financial products before making any decision.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.