Happy Chinese New Year. RSVP for TE in Singapore on February 11th and 13th. SJP WeekWatch, Stanford Brown update on AUS interest rates, and CoreLogic HVI.

Happy Chinese New Year! As the new calendar year begins, festivities and celebrations occur globally. This special time is marked by vibrant traditions, joyful gatherings, and various customs that bring people together to honour their heritage and share good fortune for the months ahead. 2025 is the year of the Snake, and it comes with the fitting advice:

“Be observant and patient in chaos.”

To help you navigate the year of the Snake, EXPATRIATE will be in Singapore hosting fun, social information events on the 11th and 13th of February. This is your chance to connect with your fellow Aussie Expat Community, enjoy food and refreshments, and be updated on the following topics:

Australian Property Market update, key market insights.

How do you present yourself to a lender as an expat?

How to build a diverse wealth portfolio, utilising your Australian Property

Financial Literacy, succession planning and investment planning.

Tax tips for Aussie Expats when repatriating.

Q & A From guests.

You can choose from the following two events.

11th February with host Alexis Livanes, Eight Wealth Management, Special Guests Christine Mount, TE Australian Property Specialist and Expat Mortgage Specialist Adam Kingston.

13th February with MC Tristan Perry, with Special Guests Christine Mount, TE Australian Property Specialist, Adam Kingston, TE Expat Mortgage Specialist and Jamie Burgmann, TE Financial Advisor.

Please click the link below to view both events in detail and RSVP for them. It is advisable to respond quickly, as only limited space is available, and spots are filling up fast.

Now, we move towards the global markets following the recent inauguration of US President Donald Trump, marking a significant shift in the political landscape that may have widespread implications for international trade and economic relationships with St James’s Place WeekWatch.

SJP WeekWatch discusses the following;

Trump Tariffs

DeepSeek and AI developments

Market Reactions

UK Debt levels

Passive or active investing and more

SB Talks: Inauguration Day, Curve Steepening and King Dollar.

We also have the Stanford Brown perspective to consider and examine and its significant impact on the Australian markets, as highlighted in the renowned Stanford Brown SB Talks series.

For the first episode of 2025, Stanford Brown CEO Vincent O’Neill again speaks with Chief Investment Officer Nick Ryder.

We discuss:

President Trump was sworn in

The shifting interest rate outlook

Currency moves around tariff fears

US reporting season kicks off

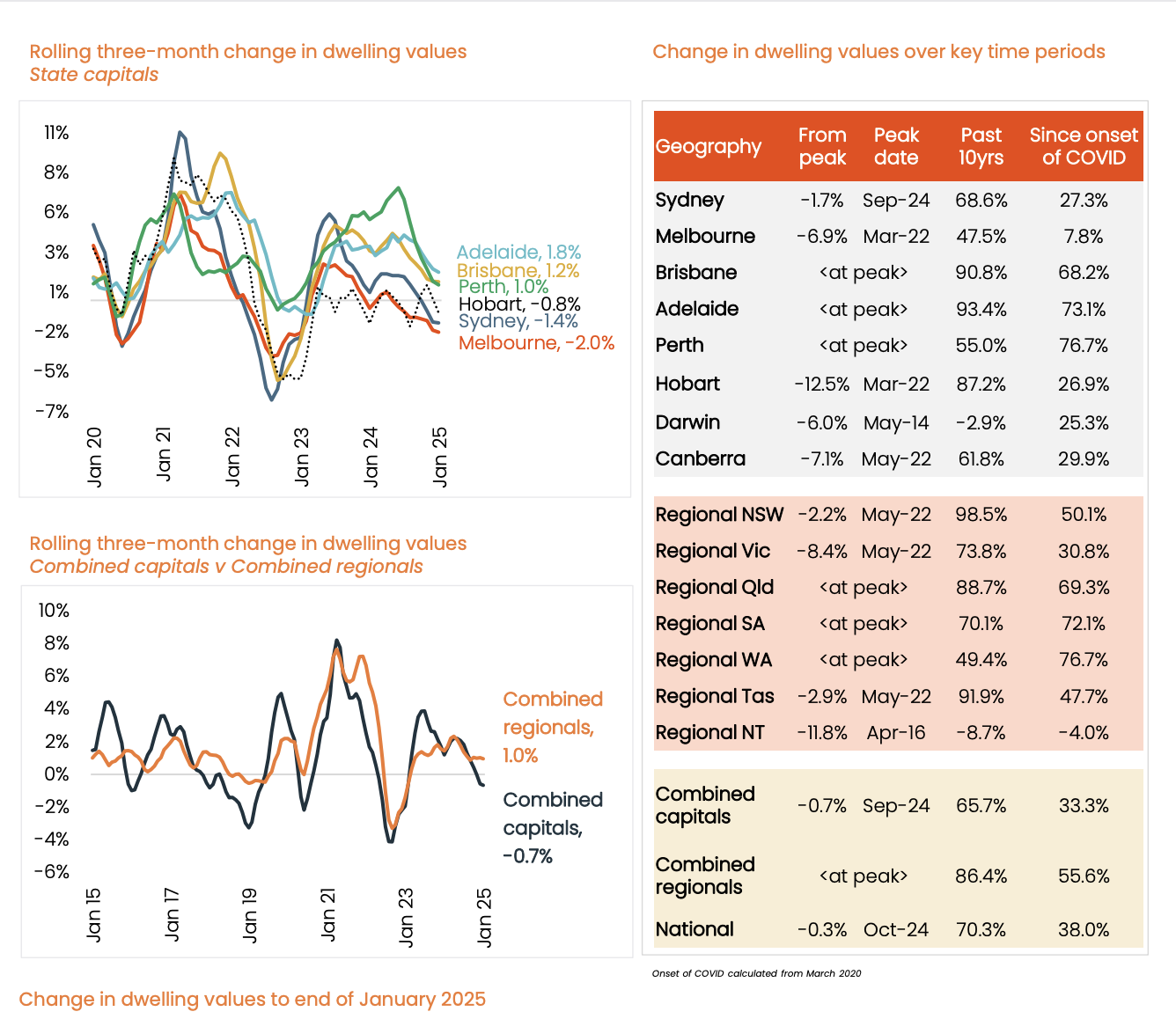

CoreLogic’s February Home Value Index (HVI) has been published, featuring the latest key property market data, including:

Australian home values held firm, with a 0.0% change in January.

Melbourne(-0.6%), Canberra (-0.5%) and Sydney (-0.4%) recorded a decline in home values in January, while Hobart remained stable.

Adelaide(0.7%), Perth (0.4%), and Brisbane (0.3%) home values have continued to rise, but there has been a clear and steady loss of momentum in these markets.

Australia's regional markets hit new heights, with dwelling values across the combined regional areas rising a further 0.4% in January, driven by renewed internal migration and healthier affordability in some regions.

A shallow downturn? The HVI is now down -0.3% since the peak in October last year, with potential support from expected rate cuts and improving consumer sentiment.

Rental growth nationally bounced slightly higher in January (0.4%), but the six-month trend has turned negative in Sydney (-0.4%) and Melbourne (-0.6%), especially in the unit sector.

Regional rental conditions have been more muscular relative to the capitals, rising 1.6% over the past three months compared to combined capitals (0.3%).

Gross rental yields nationally held firm (3.5%), and across regional Australia (4.4%).

The outlook for housing markets is looking more optimistic with rate cuts on the horizon, but affordability challenges and elevated levels of household debt remain key headwinds in 2025.

To Read the full report, click on the link below.

The information contained is general information only and does not consider your personal objectives, financial situation and needs. We strongly recommend that you do not act on any information provided in this website without individual advice from your trusted advisor. You should also obtain a copy of and consider the Product Disclosure Statement for all financial products before making any decision.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.