CoreLogic Monthly Media pack, Adam unpacks Bridging Finance, SB talks about the recent market volatility and more.

It’s been one interesting week filled with various developments. The RBA's recent cash rate decision has certainly captured attention, especially amid the ongoing market volatility that has affected many sectors. In addition, we are excited to share our Send Currency Weekly Update, which provides insights into the latest trends. Furthermore, we have an informative blog from our Mortgage Specialist that offers valuable advice and tips. Additionally, we have gathered some engaging data regarding property trends from CoreLogic Australia. We will also delve into some intriguing intra-state migration patterns that have emerged recently. Therefore, in this week’s newsletter, we cover the following topics:

Stanford Brown Talks: CEO Vincent O’Neill and CFO Nick Ryder discuss - Volatile equities, the Japanese carry trade, and the RBA rate cut off the agenda.

Send Currency International Currency Update.

Adam Kingston unpacks Bridging Finance and whether it is the right option for you.

CoreLogic has released its industry media pack, which includes more graphs, including stock on the market, and data to help you navigate the Australian Property Market as an owner-occupier or an investor.

Zoran Solano, our Brisbane-based Property Specialist, shares the intra-state migration patterns for 2024.

It’s been a big week with recent stock market volatility, which has raised concerns among investors, reflecting a combination of economic uncertainties and geopolitical tensions. Fluctuations in major indices have been driven by shifting interest rates in Japan, inflationary pressures, and fluctuating consumer confidence. Analysts observe that these rapid changes may signal broader economic trends, prompting many to reassess their investment strategies. While some investors remain cautious, others see potential opportunities amid the turmoil. To help you navigate through the recent volatility, our Australian based financial specialists at Stanford Brown have released a YouTube Video, Podcast, and Spotify Audio called:

Stanford Brown Talks: Volatile equities, the Japanese carry trade, and the RBA rate cut off the agenda

In this episode of SB Talks, Stanford Brown CEO Vincent O’Neill speaks with Chief Investment Officer Nick Ryder to discuss the following:

What drove the volatile ride for global equity markets over the past week

The Sahm rule recession indicator flashes red

Unwind of the Japanese currency carry trade

The outlook for local interest rates following the RBA’s latest decision

To download the audio or to watch the video, click on the link below.

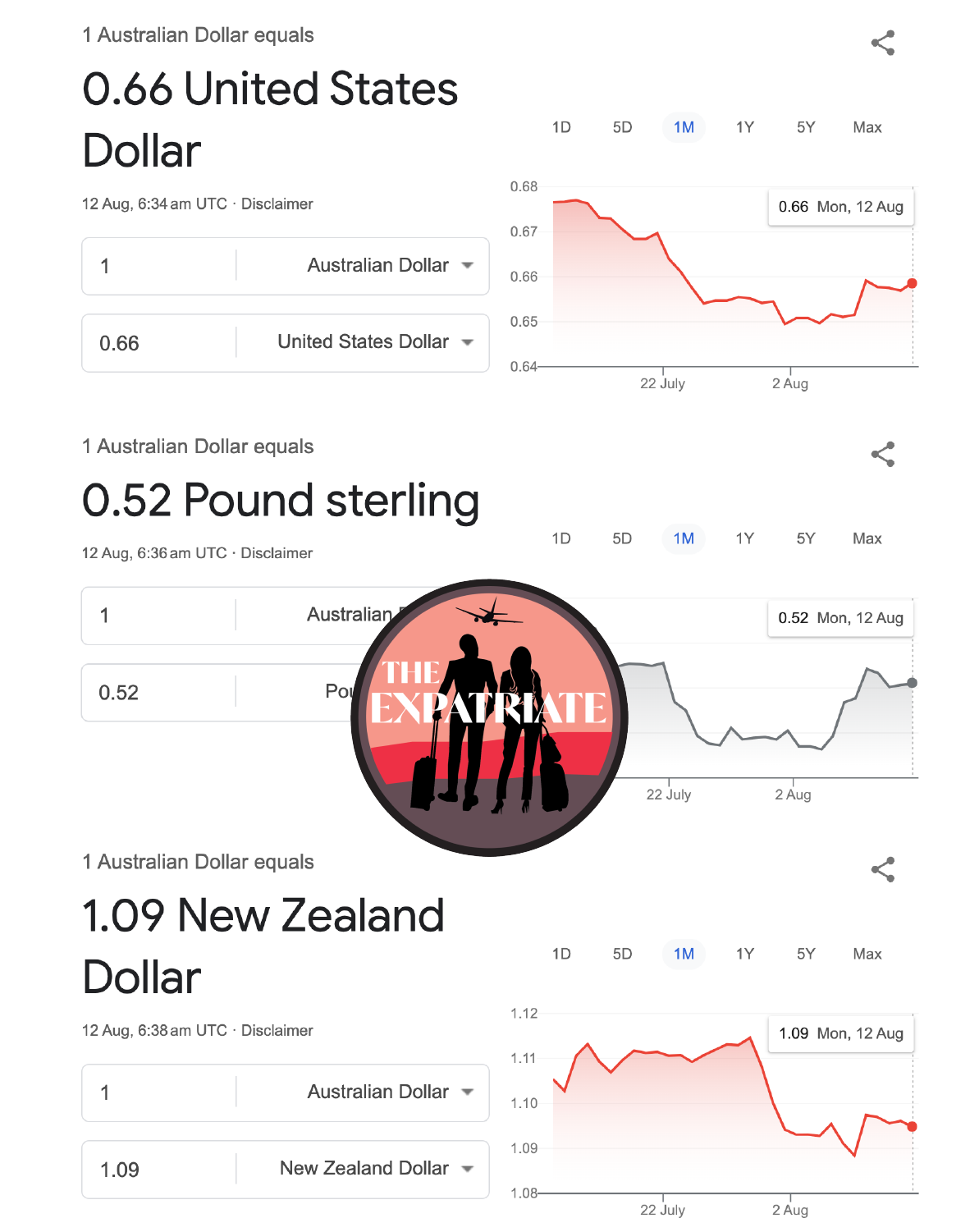

Send Payments also shared their weekly international currency update with our community, including key trends, market conditions and what to look out for this week.

GBP/AUD

The pound-to-Australian dollar exchange rate fell heavily on Thursday as hawkish remarks from Reserve Bank of Australia Governor Michelle Bullock helped the AUD outperform.

GBP/AUD fell below 1.94 as the Australian Dollar rallied, outperforming all G10 counterparts. Governor Bullock stated that inflation will likely take longer than expected to return to the 2% to 3% target band and that the RBA will not hesitate to raise interest rates again if necessary.

AUD/USD

The AUD/USD pair trades stronger near 0.6575 during the early Asian session on Monday.

Hawkish messages from the Reserve Bank of Australia (RBA) and hotter Chinese inflation data are providing some support to the Aussie.

The RBA left the interest rate unchanged at 4.35% for the sixth consecutive meeting last week. Governor Michele Bullock highlighted the upside risks to inflation and reiterated that the RBA will raise rates if needed.

To read the full update, click on the link below;

Our Australian Expat Mortgage Specialist, Adam Kingston from Australian Expatriate Finance, wrote a great blog using a recent client loan as a case study and unpacked the intricacies of Bridging Loans and if they’re right for you. Here is a snippet of his information blog below;

Bridging Finance, what is it? How does it work? Is it right for me?

Bridging finance works by allowing you to borrow a specific amount of money against the value of a property. The key features include:

Loan structure: You have two loans, the remaining loan (usually 30yrs/P&I) and the bridging loan (usually interest only over 12 months)

Slightly High Interest Rates: Given its short-term nature, bridging finance generally has a slightly higher interest rate than standard loans.

Tip: The case above the client was selling an investment property, and was able to claim back the interest repayments against the income from the property to help offset the costs.Security Requirements: Lenders require holding both properties as collateral secured against both loans. The bridging loan is generally secured against the property being sold, while the remaining loan is secured against the property being bought/held.

Flexible Repayment Terms: The bridging loan has interest-only repayments; it’s repaid when the existing property is sold.

Fees and Costs: In addition to interest, arrangement fees, valuation fees, and other costs may be associated with the loan.

For example:

The property they want to purchase is valued at $1,500,000.

The total value is, therefore, $2,500,000. This lender's maximum LVR is 80%, so we can borrow $2,000,000, but how should we split it?

Please note the existing loan gets paid out by the new loans.

The new loans are a $900,000 bridging loan (1 yr interest-only loan) and a $800,000 remaining loan (30 yr loan, P&I), so we keep within the 80% LVR rule. With the remaining loan we have $100,000 spare for stamp duty and sales costs. We chose this split because the idea is that the bridging loan, which is being repaid upon the sale of the existing property, will be totally extinguished.

The purchase occurs, then when the existing property sells, the sale proceeds pay off the bridging loan, leaving the remaining loan in place to be paid off over the next 30yrs.

Before choosing bridging finance, it is advisable to assess your financial situation, consult with a financial advisor, consult your mortgage broker, and carefully evaluate the terms and conditions set by lenders.

To read the full blog, click on the button below;

If you have any questions about your current financial position or whether a Bridging Loan is right for you, please contact Adam Kingston from Australian Expatriate Finance.

CoreLogic Monthly Chart Pack for Australia Property Market August 2024

Includes the following data:

3 Month Rolling Averages for each capital city, with housing cycles.

Sales Volumes for each Annual transaction

Median days on the market

Vendor Discounting

Listings in each region and why it is putting pressure on or discounting prices.

Weekly auction clearance rates.

Rental markets and Rental Yields.

Dwelling Housing approvals

Finance and lending, including investor lending and first home buyers, housing credit

Chart of the month

To download the CoreLogic Monthly Chart Pack for Australia Property Market August 2024 click on the link below.

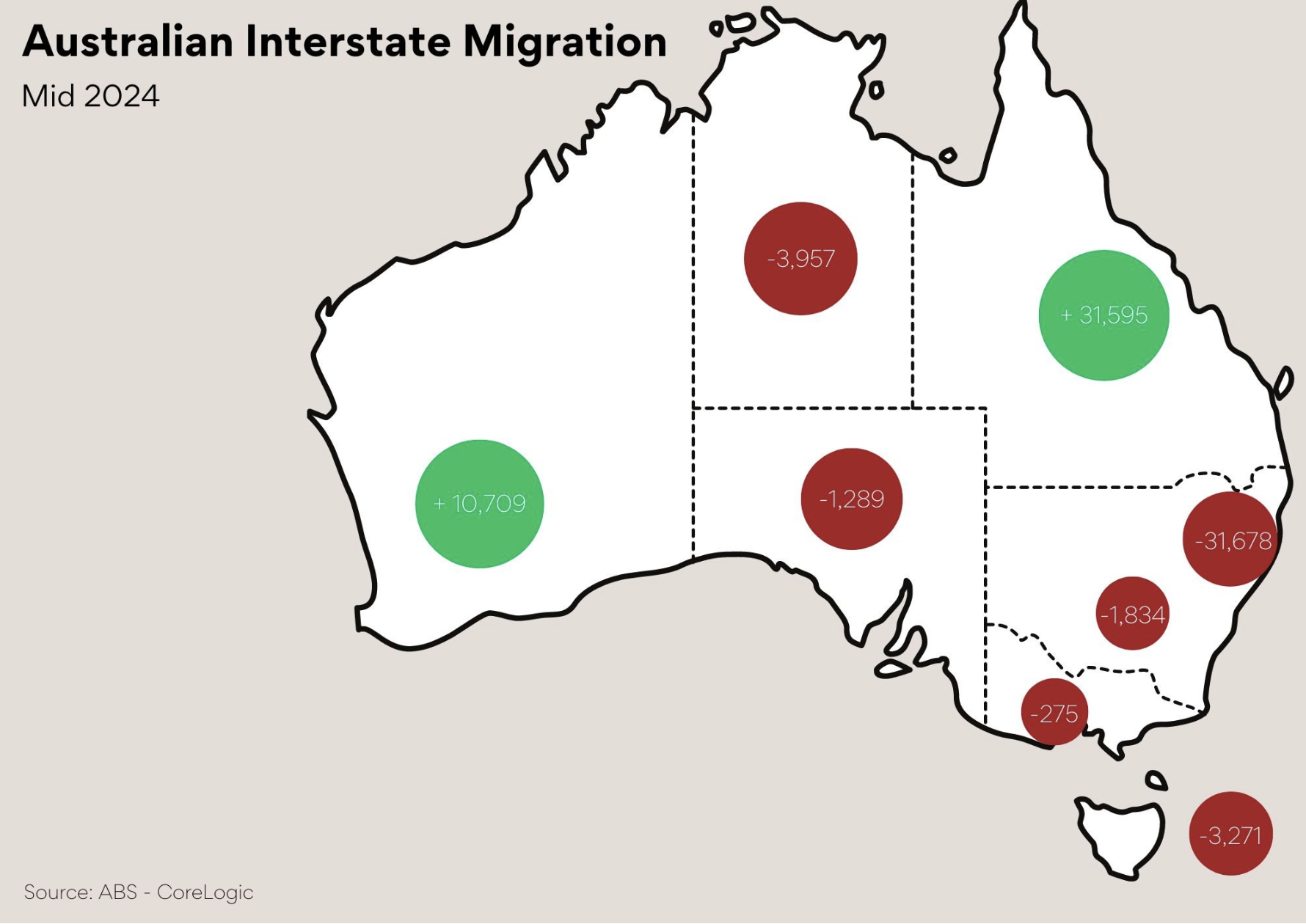

The Impact of Internal Migration on Australia's Property Market, by Zoran Solano, Hot Property Buyers Agency.

In recent years, Australia has witnessed a notable shift in internal migration patterns, with Queensland emerging as the frontrunner in attracting new residents. According to the latest data, Queensland has welcomed approximately 31,000 people on a rolling annual basis, significantly outpacing its closest competitor, Western Australia, which has seen around 10,700 new arrivals.

Queensland's Rise: A Hotbed for Property Growth

This influx of new residents into Queensland has not only reshaped its demographic landscape but also exerted a profound influence on the local property market. One of the most striking indicators of this impact is the robust annual capital gain experienced by the state. Queensland, along with Western Australia, leads the nation in terms of annual property price appreciation. This surge in capital growth can be largely attributed to the fundamental economic principle of supply and demand.

Supply and Demand Dynamics

As more people flock to Queensland, the demand for housing has surged, creating a shortage of available dwellings. This imbalance between supply and demand has driven property prices upwards, making Queensland one of the hottest markets for real estate investment in Australia today. The scarcity of new dwellings further exacerbates this situation, leaving many newcomers struggling to find suitable accommodation upon their arrival.

To read Zoran’s full blog, click on the link below;

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.