CoreLogic February Home Value Index (HVI) Report.

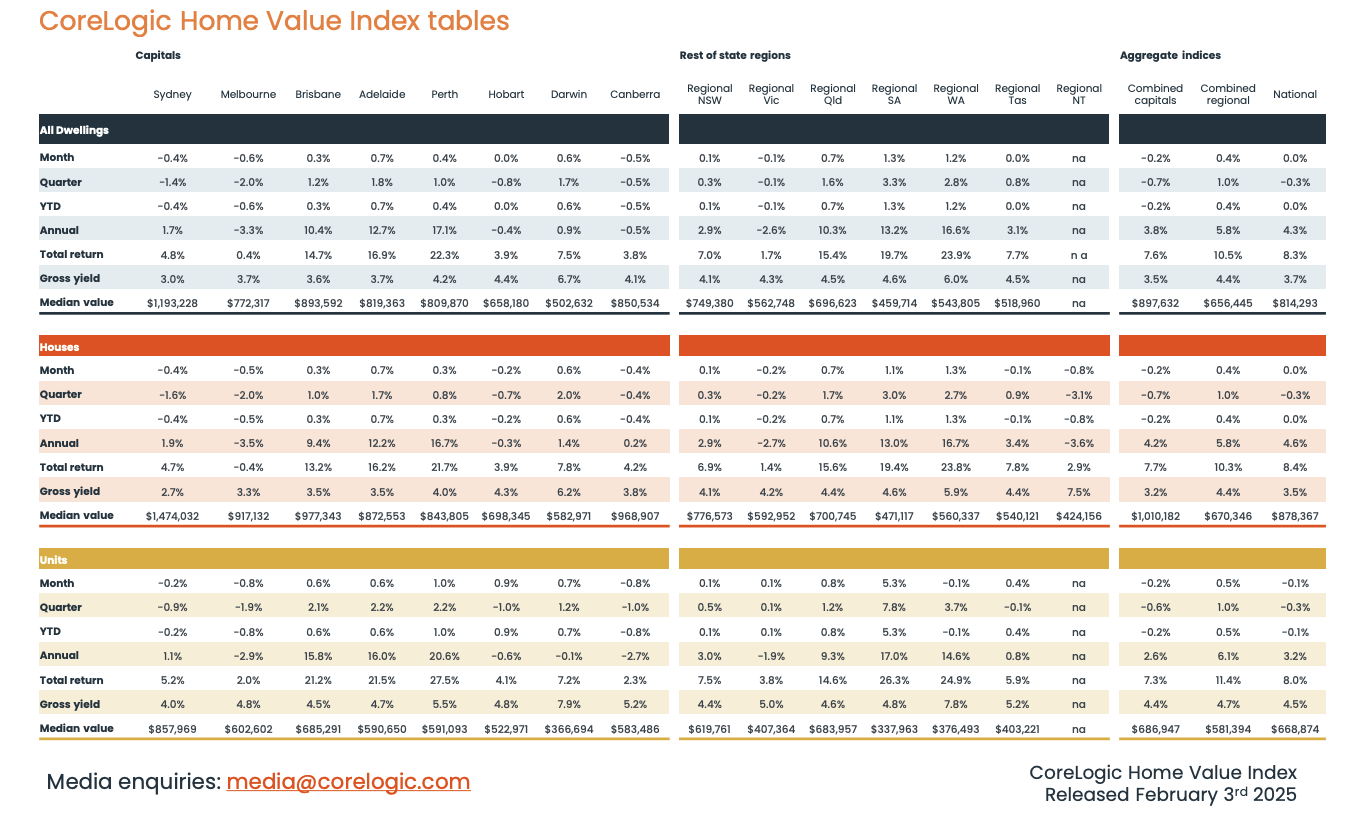

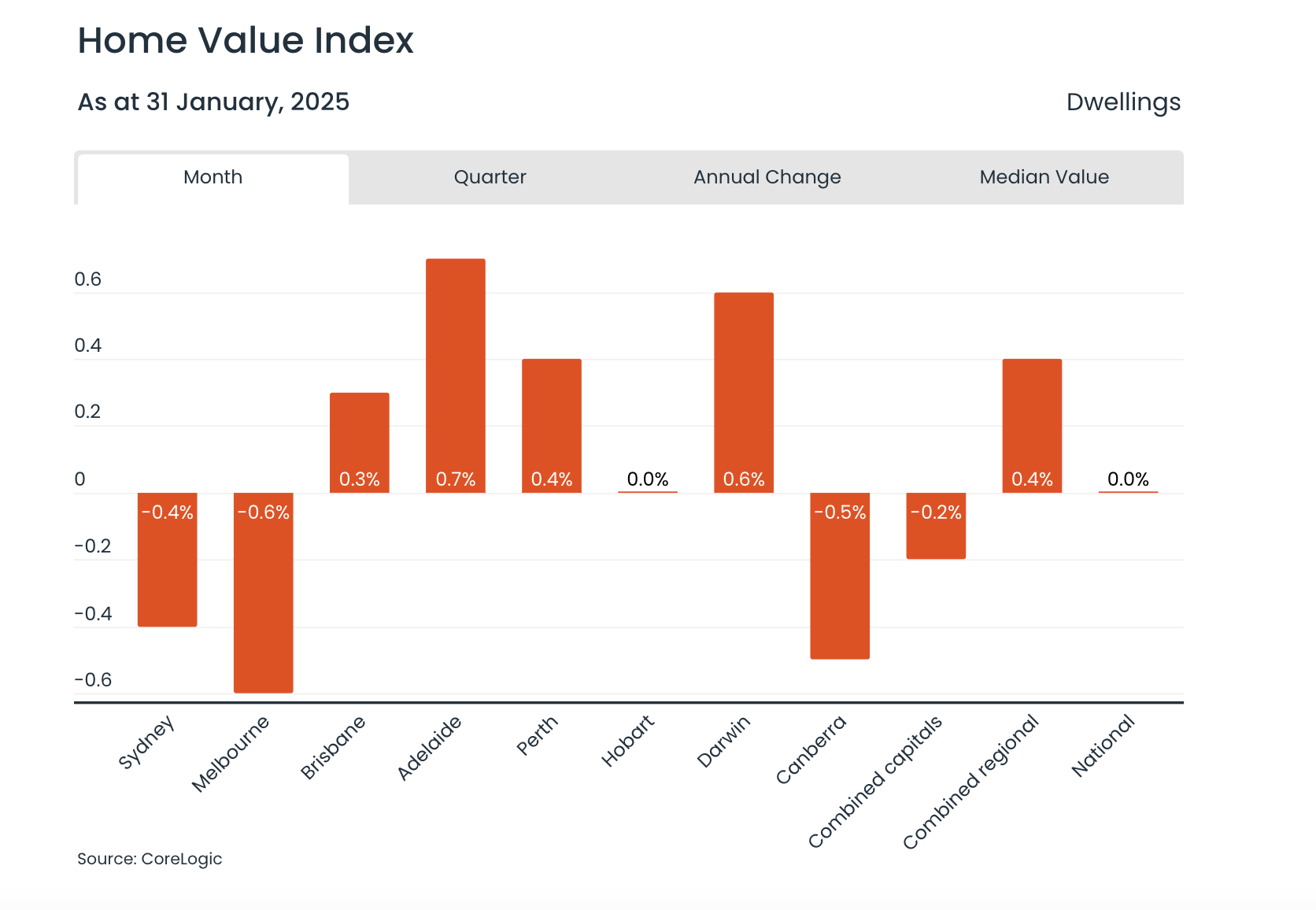

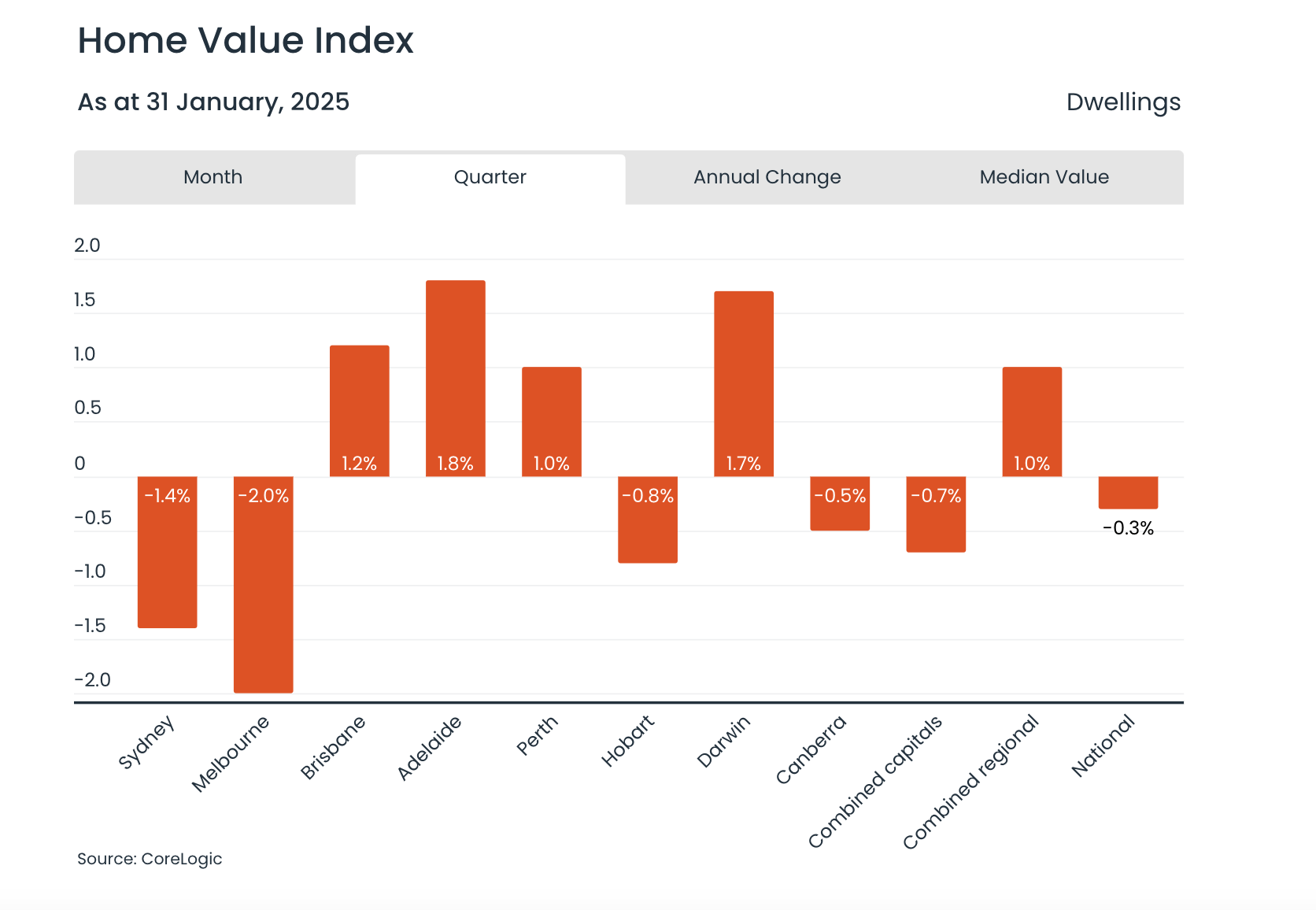

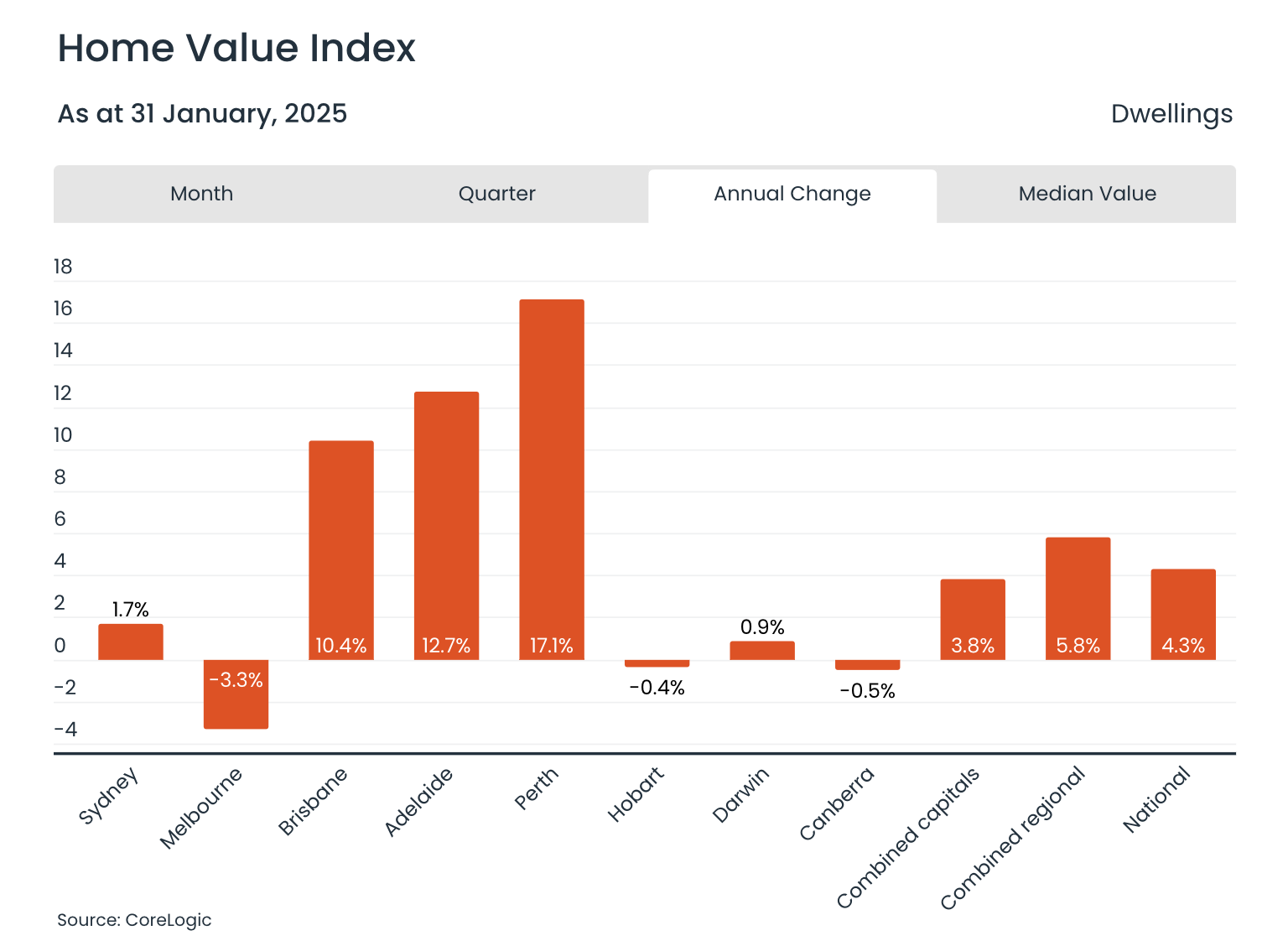

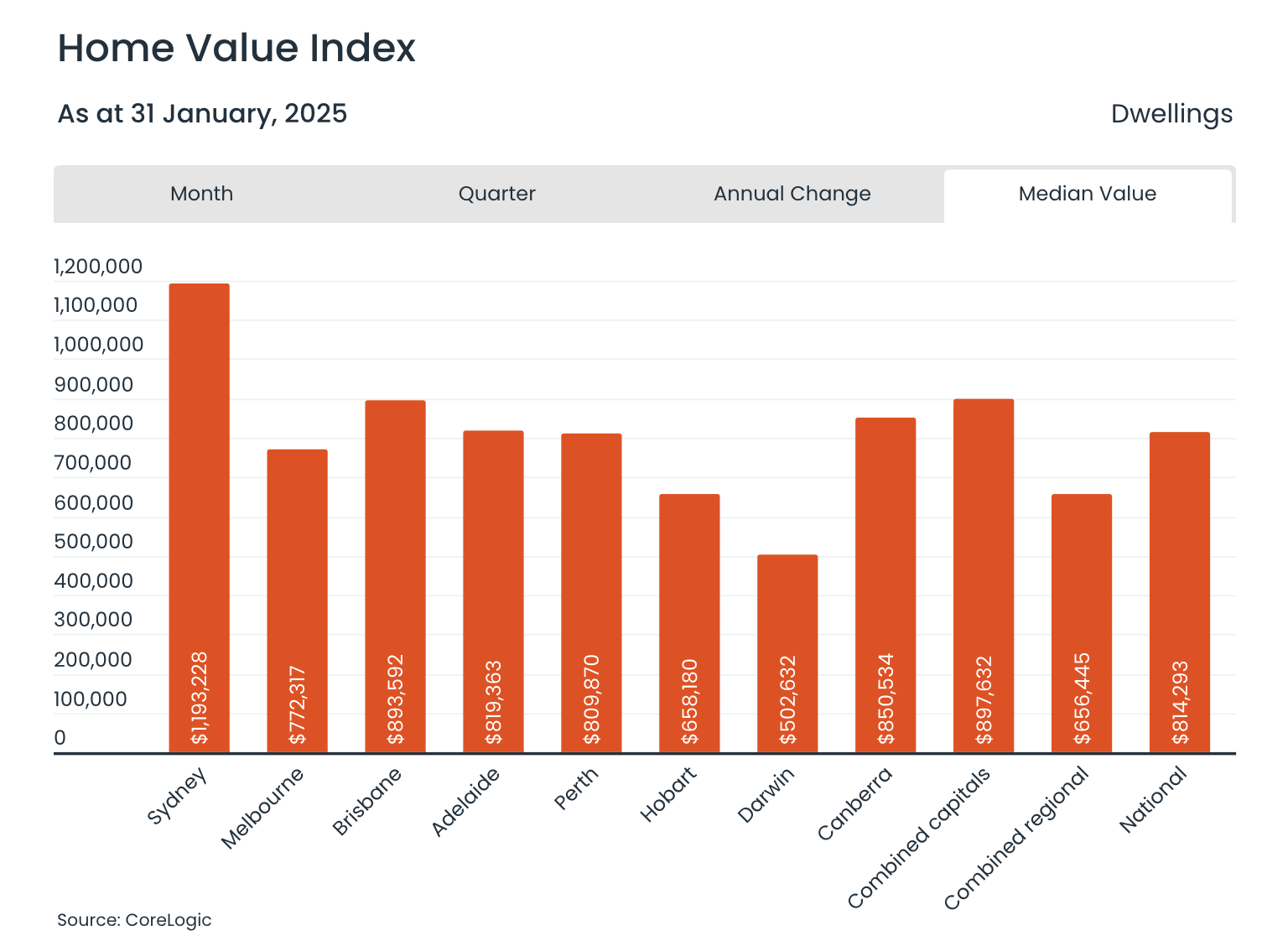

CoreLogic’s February Home Value Index (HVI) and reporting Australian home values held firm, with a 0.0% change in January and Regional Area’s rising 0.4%.

Not all markets are equal; here are our key takeaways below;

Melbourne(-0.6%)

Canberra (-0.5%)

Sydney (-0.4%)

Recorded a decline in home values in January, while Hobart remained stable.

Adelaide(0.7%)

Perth (0.4%),

Brisbane (0.3%)

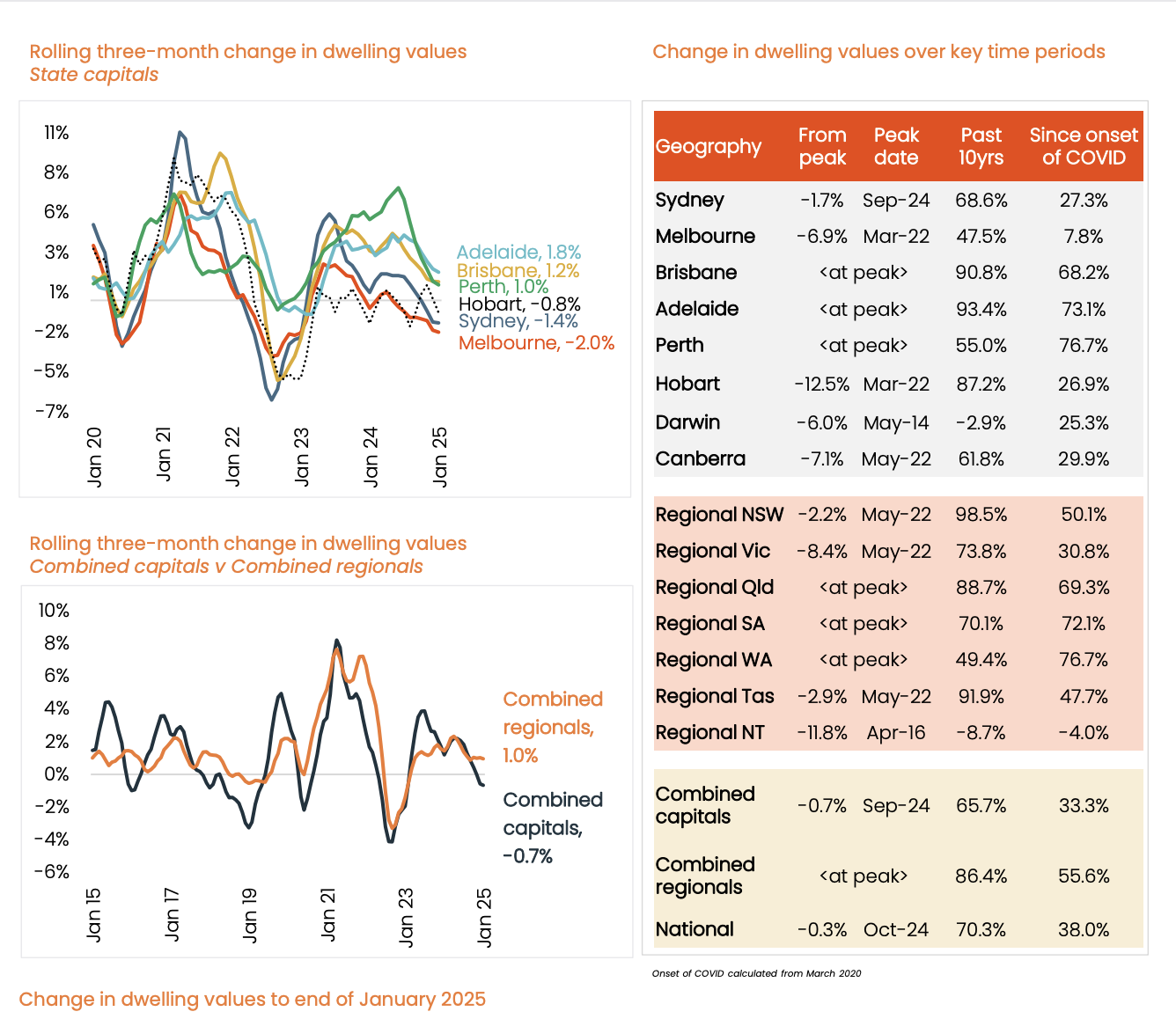

Home values have continued to rise, but there has been a clear and steady loss of momentum in these markets; they are showing they are still at the peak of their cycle.

Australia's regional markets hit new heights;

REG QLD+0.7

REG WA +1.2

REG SA +1.3

Are still at the cycle's peak, with dwelling values across the combined regional areas rising a further 0.4% in January, driven by renewed internal migration and healthier affordability in some regions.

“Regional markets seem to be benefitting from a second wind of internal migration, along with an affordability advantage in

some markets, and what looks to be some permanency in hybrid working arrangements across some occupations

and industries.”

A shallow downturn? The HVI has now been down -0.3% since the peak in October last year, with buyers sitting on the fence, waiting for potential support from expected rate cuts and improving consumer sentiment.

Rental growth nationally bounced slightly higher in January (0.4%), but the six-month trend has turned negative in Sydney (-0.4%) and Melbourne (-0.6%), especially in the unit sector.

“Finally, renters are seeing some relief after a period of extreme rental growth. Over the past five years, capital city rents have surged by 37%. The previous five-year period saw rents rise by just 5%.”

Regional rental conditions have been more robust relative to the capitals, rising 1.6% over the past three months compared to combined capitals (0.3%). Gross rental yields nationally held firm (3.5%) and across regional Australia (4.4%).

The outlook for housing markets is looking more optimistic with rate cuts on the horizon, but affordability challenges and elevated levels of household debt remain key headwinds in 2025.

To Read the full report, click on the link below.

The information contained is general information only and does not consider your personal objectives, financial situation and needs. We strongly recommend that you do not act on any information provided in this website without individual advice from your trusted advisor. You should also obtain a copy of and consider the Product Disclosure Statement for all financial products before making any decision.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.