St James’s Place Weekwatch 9th September 2024

Thank you, David Gardner and St James’s Place Asia and Middle East, for sharing your valuable market insights with our community in the SJP 9th September Weekwatch.

This week, SJP will delve into the intricacies of the global financial markets, including Nvidia’s recent annual results, September's historic poor performance, the upcoming election and its effect on the markets, and interest rates, UK and Europe Markets and share practical tips to enhance your wealth management strategies and a perspective on interpreting the media reports and narratives. This week’s blog covers the following points;

Stock Take

Has the ‘The Magnificent Seven,’ dream run finished?

Nvidia's recent annual results highlight its challenges with the S&P 500 and NASDAQ.

Peter McLoughlin, Head of Research at Rowan Dartington, notes that September is typically a tough month for tech.

The Russell 2000 (Trump Trade) shows strong growth.

The US market faces uncertainties as the election approaches in less than two months, with neither party clearly leading.

Upcoming debates between candidates Kamala Harris and Donald Trump are expected to provide insights into future directions.

The US Federal Reserve is predicted to cut interest rates by 0.25% to 0.50%

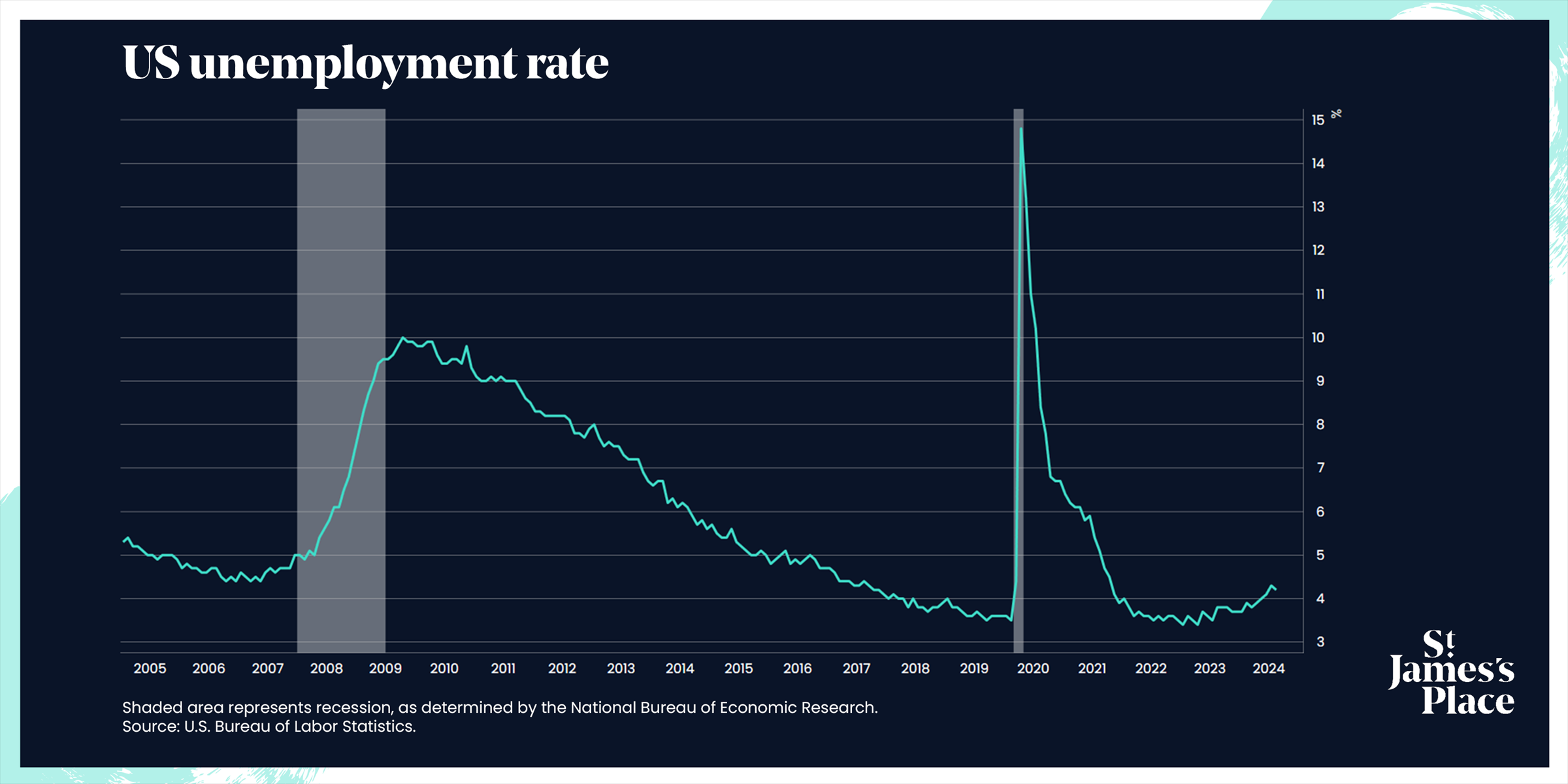

Recent job market data showed a slight unemployment drop and increased average earnings, but weaker payroll figures led to less market reaction than previous drops.

The Bank of England's Monetary Policy Committee will meet next week to discuss interest rates and decide how many more cuts will follow.

In October, Labour will present its first budget under Keir Starmer’s government, which is expected to involve tax increases or spending cuts due to tough decisions ahead.

In Germany, Volkswagen announced potential factory closures as part of cost-cutting efforts, reflecting struggles in German manufacturing exacerbated by high energy prices.

Mark Dowding, Chief Investment Officer at BlueBay, points out that Germany's high energy costs compared to other countries contribute to its economic difficulties. He suggests that the country’s shift away from nuclear power has led to greater reliance on coal, indicating a need for reevaluation of its energy policies.

France reached a political agreement last week when President Macron chose Michel Barnier as the new Prime Minister.

BlueBay manages funds for St. James's Place.

Wealth Check

Accountants, lawyers, and other professionals require strong financial advice, similar to others in different fields, however their financial decisions should not harm their professional integrity.

"As a professional, you may face more scrutiny," warns Obi Nnochiri, Head of Private Client Consultancy at St. James's Place. "You need financial advice that can withstand that scrutiny; otherwise, you risk damage to your reputation, professional penalties, or even legal trouble."Conflicts of interest are a good example of the potential danger. The work you do with a corporate client, say, could give rise to a conflict if you also have exposure to the client through your personal finances – perhaps because you’ve invested in the business.

Insider trading can be a serious issue. As a business adviser, you often have access to confidential information that can impact a company's value. If you buy or sell shares before this information is public, you may be breaking the law.

Tax planning can also be challenging. HMRC has become stricter on tax avoidance, and disputes with tax authorities can be risky and expensive. For those in professional services, such disputes can harm your reputation and may lead to penalties from your regulatory body.

If you run your own business, like a law or accountancy firm, you need financial advice tailored to your situation. Your income may fluctuate due to dividends, bonuses, or profit shares, making tax planning more complex and requiring careful attention.

Tax rates and reliefs can change at any time and usually depend on personal situations.

In The Picture

The small decrease in the unemployment rate last week may have eased concerns for US policymakers, but it was offset by weaker payroll data and rising wage growth.

The Last Word

“All political forces will have to be respected and listened to, and I mean all.”

The information contained is correct as of the date of the article. The information contained does not constitute investment advice and is not intended to state, indicate or imply that current or past results indicate future results or expectations. Where the opinions of third parties are offered, these may not necessarily reflect those of St. James's Place.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. “FTSE Russell®” is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.”

© S&P Dow Jones LLC 2024; all rights reserved

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.