Send Currency Market Update 4th September 2023

Last week saw some strength return to the AUD as the greenback lost some steam due to weak data and a possible rate halt. Positive signs from China also helped the Aussie recover some ground, but how long will this last? Moreover, August has ended, and the seasonal analysis of September tells us that the AUD tends to weaken towards the latter half of this month. This is something to take note of before making your trades.

Let`s dive in for more details.

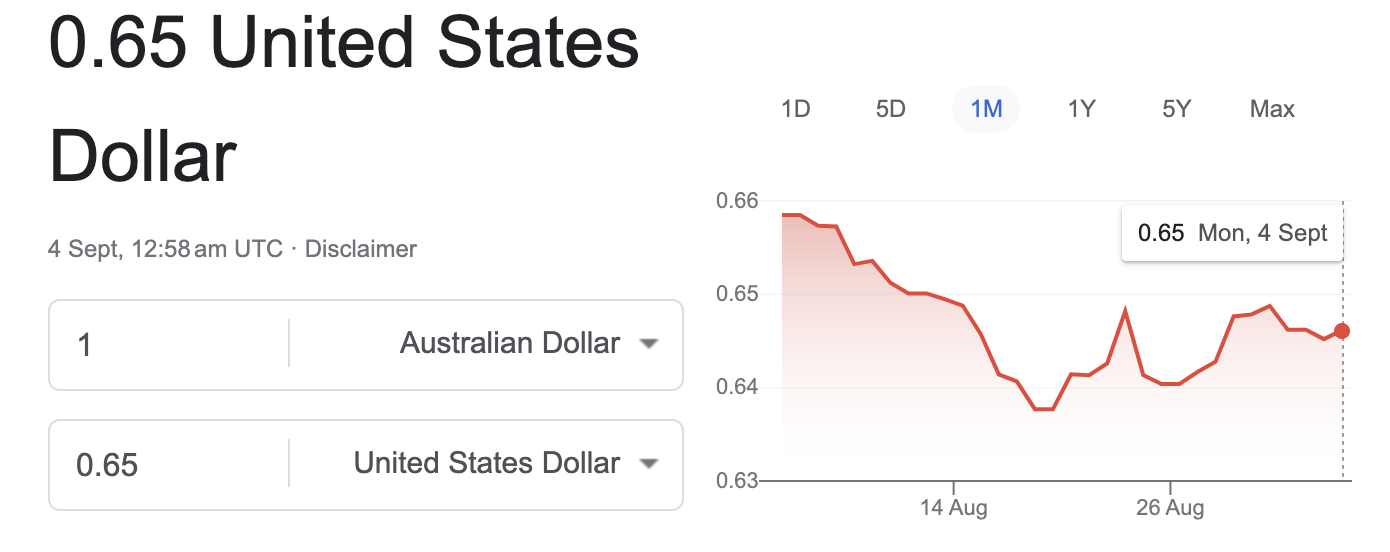

AUD - USD

The AUD/USD pairing has been on a notably positive trajectory recently, with the Australian dollar gaining 0.49% against the US dollar last week. However, current market sentiment leans towards selling the AUD for the USD.

This comes in the wake of a series of economic events. The US economic growth data has been soft lately, capping US yields and weighing on the US dollar globally. Meanwhile, a moderation in Australian inflation has lessened the need for further rate hikes by the Reserve Bank of Australia (RBA), which is expected to hold steady for the third straight month.

Furthermore, US August payroll data indicated an increase in unemployment to 3.8% from 3.5% in July, while average hourly earnings were lower than estimates. This disappointing economic data has contributed to financial markets increasingly pricing in a less dovish Federal Reserve down the road, pushing down Treasury yields and allowing anti-fiat gold to outperform.

Looking ahead if the US economy rebounds and the Fed adopts a less dovish stance, this could bolster the USD and put pressure on the AUD/USD pair.

AUD - EUR

The AUD/EUR pairing has shown some noteworthy movement recently, with the Australian dollar gaining 0.86% against the euro last week. However, market sentiment currently leans towards selling the AUD for the EUR.

This shift is happening amid a complex economic backdrop in Europe. The European Central Bank (ECB) is grappling with high inflation, which held steady at 5.3% this month, but underlying price growth fell. This divergence complicates matters for the ECB and makes it more likely they will keep interest rates unchanged next month rather than raising them.

Moreover, comments from influential German policymaker Isabel Schnabel have led traders to trim bets on an ECB rate hike in September. These factors have exerted downward pressure on the euro, contributing to the AUD's recent gains against it.

Looking ahead, the immediate future of the AUD/EUR pairing will likely be influenced by these central bank decisions, as well as any significant shifts in inflation and economic data from both regions.

Don't miss out on the best rates. Transfer Today and maximize your returns.

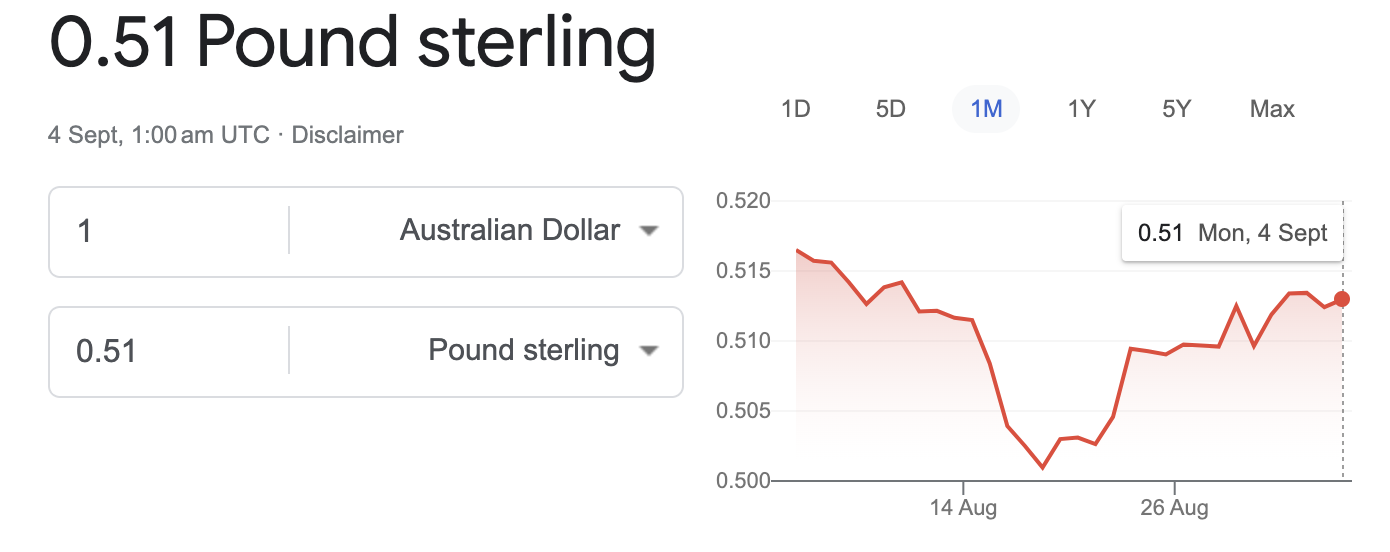

AUD - GBP

The AUD/GBP pairing has been on a relatively positive trajectory recently, with the Australian dollar gaining 0.67% against the British pound last week. This move comes amid a backdrop of surprisingly strong growth in the UK economy, as revealed in the newly released UK Annual National Accounts 2023 (Blue Book).

The report shows that the UK's GDP is now estimated to be 0.6% above pre-pandemic levels in Q4 2021, a significant upward revision from the previous estimate of 1.2% below. This new data might prompt investors to reassess their views on the UK economy and could potentially bolster the GBP.

However, the UK is grappling with high inflation, currently standing at 6.8%. Despite this, the market is only pricing a Bank of England (BoE) rate peak at 5.75%, with expectations that inflation will eventually fall below the BoE rate, leading to positive real rates. This suggests a more restrictive monetary policy ahead, which could put pressure on the GBP and potentially benefit the AUD/GBP pairing.

Looking ahead, if the BoE takes a more hawkish stance to combat inflation, it could strengthen the GBP and put pressure on the AUD/GBP pair. Conversely, if inflation remains stubbornly high and real rates turn positive, it could weigh on the GBP and provide a boost for the AUD.

AUD - NZD

The AUD/NZD pairing has shown some promising signs recently, with the Australian and New Zealand dollars both edging higher. This upward trend was influenced by better-than-expected domestic economic data and a slight improvement in China's manufacturing activity, Australia's largest export destination. Business investment in Australia notably surged, marking a high point amidst a challenging quarter for the economy.

However, despite these positive indicators, selling pressure on the Aussie persists, and the upcoming interest rate decision by the Reserve Bank of Australia (RBA) could be a critical test. The RBA is widely expected to maintain rates for the third consecutive month, which may influence the trajectory of the AUD/NZD pairing.

Meanwhile, the Reserve Bank of New Zealand (RBNZ) has held firm, having increased its rates dramatically over the past year. This has been somewhat of a deterrent for the Kiwi, but recent survey data indicates a boost in business confidence, suggesting potential stability.

In the immediate future, the AUD/NZD pairing's performance will likely be influenced by these central bank decisions, as well as any significant shifts in China's economic health.

If Australia's business investment continues to thrive and China's manufacturing sector shows further signs of revival, we could see a stronger rally for the AUD against the NZD.

Conversely, if inflation pressures in Australia intensify and China's recovery wanes, the AUD may face headwinds, creating an opportunity for the NZD to gain ground.

The Expatriate always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.